In the dynamic world of investments, understanding the potential of US large cap stocks ETFs can be a game-changer for investors seeking high growth and stability. These exchange-traded funds (ETFs) offer a gateway to some of the most prominent companies in the United States, providing investors with exposure to the market leaders in various sectors.

Understanding Large Cap Stocks ETFs

Large cap stocks are shares of companies with a market capitalization of over $10 billion. These companies are often established and well-known, with a history of profitability and stability. An ETF that focuses on large cap stocks, such as the US Large Cap Stocks ETF, is designed to track the performance of these companies, providing investors with a diversified portfolio of top-performing stocks.

Benefits of Investing in US Large Cap Stocks ETFs

Diversification: One of the key benefits of investing in a large cap stocks ETF is diversification. By investing in a single ETF, investors gain exposure to a wide range of companies across various sectors, reducing the risk associated with investing in a single stock.

Stability: Large cap stocks are typically more stable than smaller companies. These companies have well-established business models and are less likely to be affected by market volatility.

Potential for Growth: Despite their stability, large cap stocks often offer significant growth potential. Many of these companies are leaders in their respective industries and have the resources to expand and innovate.

Low Cost: Investing in a large cap stocks ETF is often more cost-effective than buying individual stocks. ETFs typically have lower fees and require less research and monitoring.

How to Choose the Right US Large Cap Stocks ETF

When selecting a US large cap stocks ETF, it’s important to consider several factors:

Fund Composition: Look for an ETF that tracks a broad range of large cap stocks, ensuring diversification across various sectors.

Performance: Check the historical performance of the ETF to get an idea of its track record.

Expenses: Consider the management fees and other expenses associated with the ETF.

Dividends: Some large cap stocks ETFs offer attractive dividend yields, which can be a significant source of income for investors.

Case Studies

To illustrate the potential of US large cap stocks ETFs, let’s consider two popular ETFs:

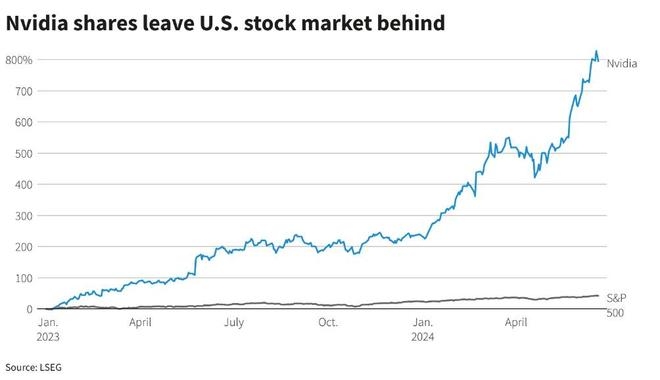

Vanguard S&P 500 ETF (VOO): This ETF tracks the performance of the S&P 500 index, which consists of the 500 largest companies in the United States. It offers investors exposure to a wide range of industries and has a low expense ratio.

iShares Russell 1000 ETF (IWF): This ETF tracks the performance of the Russell 1000 index, which includes the 1,000 largest companies in the United States. It provides investors with exposure to a diverse portfolio of large cap stocks and has a strong history of performance.

Conclusion

Investing in US large cap stocks ETFs can be a smart way to gain exposure to the market leaders in various sectors. By understanding the benefits and carefully selecting the right ETF, investors can unlock significant growth potential while enjoying the stability of these well-established companies.

Iran Flash Crash: How a Single Country'? us steel stock dividend