As the markets prepare for the release of crucial economic data, US stock futures are displaying a mixed outlook. Investors are cautiously optimistic, as they await insights into the current state of the economy. This article delves into the potential implications of this mixed futures scenario, analyzing the various factors at play.

Market Sentiment

The mixed futures situation reflects a split in market sentiment. While some investors are upbeat about the potential for growth, others are concerned about the uncertainties ahead. This uncertainty is primarily driven by factors such as rising inflation, geopolitical tensions, and the ongoing COVID-19 pandemic.

Inflation Concerns

One of the key factors influencing market sentiment is the issue of inflation. The recent surge in inflation has raised concerns about the Federal Reserve's response. Investors are closely monitoring the central bank's policies, as they anticipate potential interest rate hikes in the near future. This possibility has led to some cautiousness in the markets, as higher interest rates can negatively impact economic growth and corporate profits.

Geopolitical Tensions

Geopolitical tensions, particularly around the ongoing conflict in Ukraine, have also contributed to the mixed futures scenario. The situation has raised concerns about global supply chains and energy prices, which could further impact economic stability and corporate earnings.

COVID-19 Pandemic

The ongoing COVID-19 pandemic continues to cast a shadow over the market outlook. While vaccinations have significantly reduced the risk of severe illness, concerns about new variants and potential lockdowns remain. This uncertainty has led to cautiousness among investors, as they await further clarity on the economic impact of the pandemic.

Case Studies

To better understand the potential implications of the mixed futures scenario, let's examine a couple of case studies:

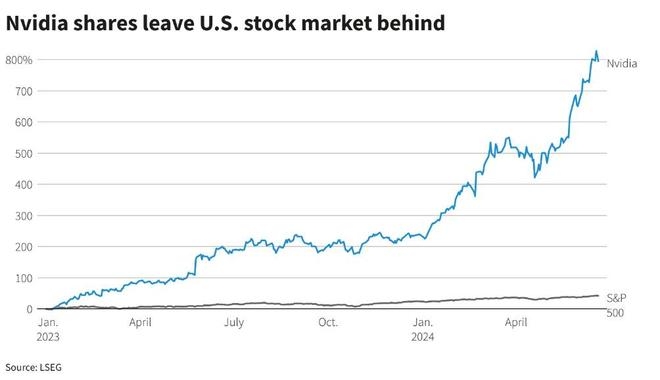

Tech Sector: The tech sector has been a significant driver of the stock market's growth over the past few years. However, recent concerns about rising inflation and increased interest rates have led to some cautiousness in the sector. Companies such as Apple and Amazon have seen their stock prices decline in recent weeks, reflecting this cautious sentiment.

Energy Sector: The energy sector has been one of the strongest performers in recent months, driven by rising energy prices. However, concerns about geopolitical tensions and potential sanctions have raised uncertainty in the sector. Companies such as ExxonMobil and Chevron have seen their stock prices fluctuate as investors weigh the potential risks and rewards.

Conclusion

The mixed outlook for US stock futures ahead of key economic data reflects a cautious approach among investors. Factors such as inflation, geopolitical tensions, and the ongoing COVID-19 pandemic continue to influence market sentiment. As investors await further insights, they must remain vigilant and adapt to the changing landscape.

US 4th Qtr 2018 Stock Market: A Deep Dive i? us steel stock dividend