The stock market has been experiencing a turbulent period lately, primarily due to growing concerns about the United States' debt situation. As the national debt continues to soar, investors are becoming increasingly anxious, leading to a slump in stock prices. In this article, we will delve into the reasons behind this decline and explore the potential implications for the economy.

The Rising National Debt

The national debt of the United States has been a topic of concern for years. However, the situation has become more pressing as the debt continues to rise at an alarming rate. According to the U.S. Treasury Department, the national debt has exceeded $31 trillion, a figure that is expected to grow even further in the coming years.

Several factors have contributed to this increase. The COVID-19 pandemic has led to significant government spending on stimulus packages and other relief measures. Additionally, the country's aging population and rising healthcare costs have put further strain on the budget.

Impact on the Stock Market

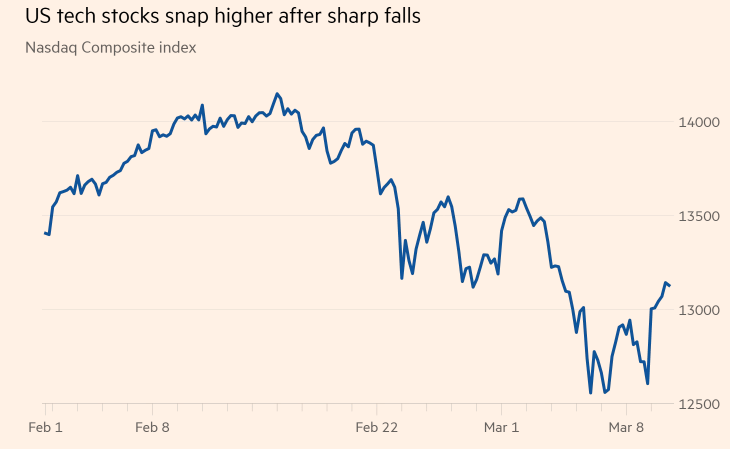

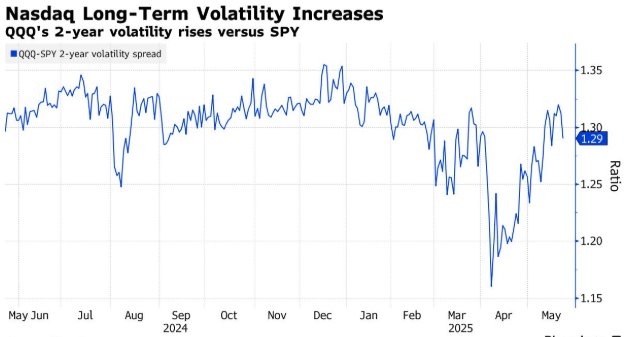

The rising national debt has had a direct impact on the stock market. As investors become increasingly concerned about the country's financial stability, they are selling off stocks, leading to a slump in prices. This trend has been particularly evident in sectors that are highly sensitive to economic conditions, such as technology and consumer discretionary.

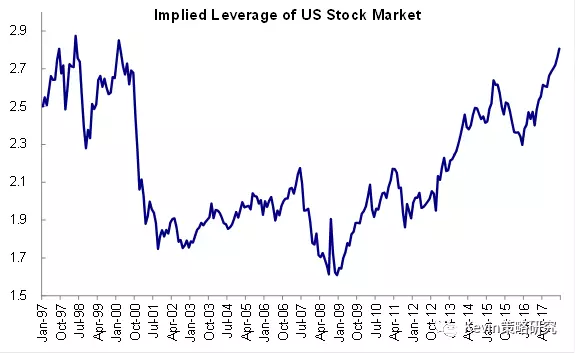

One of the key reasons for this is the fear of higher interest rates. As the national debt continues to rise, the government will need to borrow more money, which could lead to higher interest rates. This would make it more expensive for businesses to borrow money for expansion and investment, potentially leading to lower corporate earnings and a further decline in stock prices.

Case Study: Tesla and Apple

To illustrate the impact of the rising national debt on the stock market, let's consider two major companies: Tesla and Apple.

Tesla, the electric vehicle manufacturer, has seen its stock price plummet in recent months. One of the primary reasons for this decline is the company's high debt levels. As the national debt continues to rise, investors are becoming increasingly concerned about Tesla's ability to manage its debt and continue growing at its current pace.

Similarly, Apple, the technology giant, has also been affected by the rising national debt. The company's stock price has experienced a significant decline, primarily due to concerns about the global economic outlook and the potential impact of higher interest rates on its business operations.

What Does This Mean for Investors?

For investors, the rising national debt and its impact on the stock market present a complex situation. While it is difficult to predict the exact outcome, there are several strategies that investors can consider:

Diversify Your Portfolio: Diversifying your portfolio can help mitigate the risk associated with the rising national debt. Consider investing in sectors that are less sensitive to economic conditions, such as healthcare and consumer staples.

Stay Informed: Keep up-to-date with the latest news and developments related to the national debt and the economy. This will help you make informed decisions about your investments.

Consider Bonds: While bonds are typically considered less risky than stocks, they can provide a stable source of income during times of economic uncertainty.

In conclusion, the rising national debt and its impact on the stock market are a cause for concern. As investors, it is crucial to stay informed and adapt your investment strategy accordingly. By diversifying your portfolio and staying informed, you can navigate this challenging environment and protect your investments.

Marijuana Companies: A Growing Presence in ? us steel stock dividend