In the ever-evolving financial landscape of the United States, the question of how many people own stocks is a topic of significant interest. Stocks have long been considered a key component of wealth accumulation and financial security for many Americans. This article delves into the statistics, trends, and insights surrounding stock ownership in the US.

The State of Stock Ownership in the US

According to a report by the Federal Reserve, as of 2020, approximately 55% of American households owned stocks, either directly or indirectly through mutual funds, retirement accounts, or exchange-traded funds (ETFs). This figure includes stocks held in brokerage accounts, 401(k) plans, and individual retirement accounts (IRAs).

Trends Over Time

Historically, stock ownership has been on the rise in the US. In the 1970s, only about 30% of American households owned stocks. However, this figure has more than doubled over the past five decades. This upward trend can be attributed to several factors, including:

- Economic Growth: The US economy has experienced significant growth over the past few decades, leading to increased corporate profits and higher stock prices.

- Retirement Plans: The rise of employer-sponsored retirement plans, such as 401(k)s, has made it easier for Americans to invest in stocks.

- Low Interest Rates: With interest rates remaining low for an extended period, many investors have turned to stocks for higher returns.

Types of Stock Ownership

Stock ownership in the US can be categorized into three main types:

- Direct Ownership: This involves purchasing stocks through a brokerage account or online trading platform.

- Indirect Ownership: This includes owning stocks through mutual funds, ETFs, or retirement accounts.

- Employee Stock Ownership Plans (ESOPs): These plans allow employees to own shares of their employer's company.

Demographics of Stock Owners

The demographics of stock owners in the US vary widely. While stock ownership is relatively widespread among all age groups, certain demographics are more likely to own stocks. For example, individuals with higher incomes, higher levels of education, and higher net worth are more likely to own stocks.

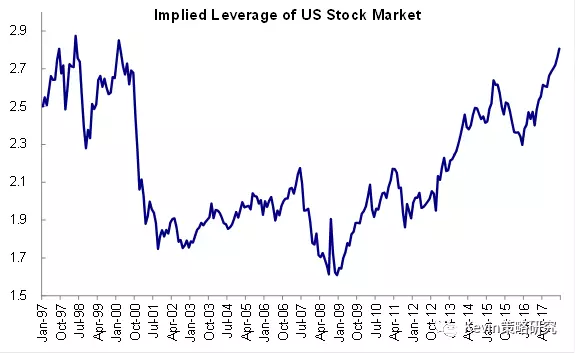

Case Study: The Great Recession of 2008

The Great Recession of 2008 had a significant impact on stock ownership in the US. As the stock market plummeted, many Americans lost a significant portion of their investments. However, despite this setback, stock ownership continued to rise in the years that followed. This demonstrates the resilience of the US stock market and the determination of Americans to rebuild their portfolios.

Conclusion

In conclusion, the number of people in the US who own stocks has reached an all-time high. This trend is likely to continue as economic growth, retirement plans, and low-interest rates continue to drive stock ownership. Whether you are a seasoned investor or just starting out, understanding the state of stock ownership in the US can help you make informed decisions about your financial future.

Hot Stocks to Watch in the US and Canada: T? us steel stock dividend