In the ever-evolving world of investment, understanding the nuances of various stocks is crucial for making informed decisions. One such stock that has gained considerable attention is the US Ecology Common Stock. This article delves into the details of this stock, offering insights into its performance, potential, and factors that influence its market value.

Understanding US Ecology

US Ecology, Inc. is a company specializing in environmental services, including waste management and recycling. The company operates across various regions in the United States, providing services that cater to a diverse range of industries. Its common stock, often referred to as "US Ecology Common Stock," represents ownership in the company and comes with voting rights.

Key Factors Influencing US Ecology Common Stock

Several factors influence the value of US Ecology Common Stock:

- Economic Conditions: The stock's performance is closely tied to the overall economic conditions. During periods of economic growth, the demand for environmental services typically increases, positively impacting the stock's value.

- Regulatory Changes: Changes in environmental regulations can significantly impact the company's operations. Stricter regulations may require additional investments in compliance, while lenient regulations can boost profitability.

- Industry Trends: The waste management and recycling industry is continuously evolving. Keeping up with the latest trends, such as the rise of sustainable practices, can contribute to the company's growth and, consequently, the stock's value.

Performance Analysis

Analyzing the performance of US Ecology Common Stock is essential for potential investors. Over the past few years, the stock has shown mixed results:

- Growth: The company has experienced consistent growth in revenue and earnings, reflecting its strong market position and operational efficiency.

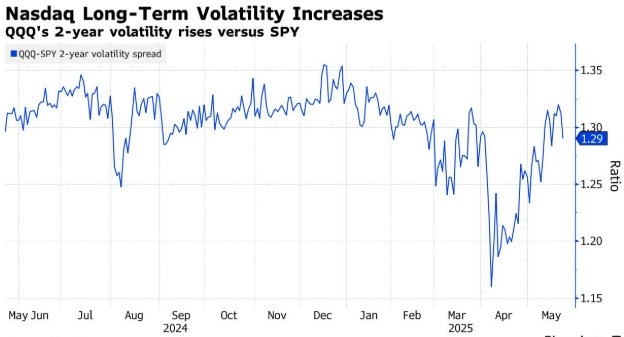

- Volatility: Like many stocks, US Ecology Common Stock has experienced periods of volatility, particularly during economic downturns or regulatory changes.

Case Studies

To better understand the potential of US Ecology Common Stock, let's look at a couple of case studies:

- Case Study 1: During a period of economic growth, the stock's value increased significantly. This growth was driven by the company's ability to capitalize on the increasing demand for environmental services.

- Case Study 2: Following a regulatory change, the stock experienced a decline. However, the company quickly adapted to the new regulations, leading to a recovery in its stock value.

Investment Opportunities

For investors considering US Ecology Common Stock, it's essential to:

- Research Thoroughly: Understand the company's financials, industry position, and potential risks.

- Diversify Your Portfolio: Investing in a single stock can be risky. Diversifying your portfolio can help mitigate potential losses.

- Monitor Market Trends: Stay updated on economic conditions, regulatory changes, and industry trends.

Conclusion

In conclusion, US Ecology Common Stock presents an intriguing investment opportunity for those interested in the environmental services sector. By understanding the factors that influence its value and staying informed about market trends, investors can make informed decisions about their investments.

Ericsson Stock US: A Comprehensive Guide to? us steel stock dividend