The rise of digital payments has revolutionized the way consumers shop, and Afterpay, an Australian fintech giant, has played a significant role in this transformation. With a growing presence in the United States, many investors are curious about the stock price of Afterpay. This article delves into the trends, analysis, and future outlook of Afterpay's US stock price.

Understanding Afterpay's Stock Price

Afterpay (ASX: APT) is an innovative payment platform that allows consumers to pay for purchases in installments without interest or fees. The company has expanded rapidly, and its US operations have become a crucial part of its growth strategy. As of the latest data, Afterpay's stock price has experienced significant volatility, reflecting both the company's success and the broader market conditions.

Recent Trends in Afterpay's Stock Price

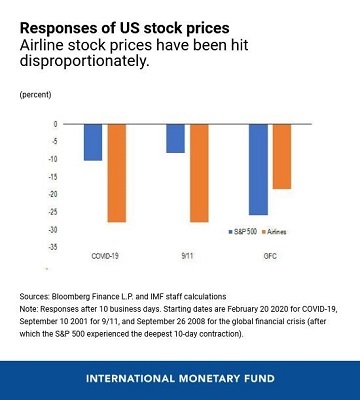

In the past few years, Afterpay's stock price has seen a remarkable rise, driven by strong revenue growth and a growing customer base. The company's US operations have been particularly impressive, with a year-over-year increase of 47% in active customers in 2020. However, the stock has also faced challenges, particularly during the COVID-19 pandemic, which led to a temporary decline in the stock price.

Analysis of Afterpay's Stock Price

Several factors have influenced Afterpay's stock price:

- Revenue Growth: Afterpay has demonstrated impressive revenue growth, with a 68% increase in revenue for the 2020 financial year. This growth has been driven by a strong customer acquisition strategy and an expanding merchant network.

- Market Conditions: The stock price of Afterpay has been affected by broader market conditions, particularly during the COVID-19 pandemic. As the pandemic led to increased economic uncertainty, the stock price experienced a temporary decline.

- Competition: The rise of other buy-now-pay-later (BNPL) companies, such as Klarna and Affirm, has also impacted Afterpay's stock price. However, Afterpay's strong brand recognition and customer loyalty have helped it maintain its market position.

Future Outlook for Afterpay's Stock Price

Looking ahead, the future of Afterpay's stock price appears promising. Several factors are expected to drive growth:

- Expansion into New Markets: Afterpay is actively seeking opportunities to expand into new markets, including Europe and Asia. This expansion could lead to significant revenue growth and further boost the stock price.

- Increased Consumer Adoption: The popularity of digital payments is expected to continue growing, which could benefit Afterpay's customer base and revenue.

- Partnerships with Merchants: Afterpay's partnerships with leading retailers have been a key driver of its growth. As the company continues to secure partnerships, it could see further revenue growth.

Case Study: Afterpay's Partnership with Nike

One notable example of Afterpay's success is its partnership with Nike. By offering Afterpay as a payment option, Nike has been able to attract new customers and increase sales. This partnership is just one of many that Afterpay has formed with leading retailers, demonstrating the company's ability to drive growth through strategic partnerships.

In conclusion, Afterpay's stock price has experienced significant volatility, reflecting both the company's success and the broader market conditions. However, the future outlook for Afterpay appears promising, with several factors expected to drive growth in the coming years. As consumers continue to embrace digital payments and Afterpay expands into new markets, the company's stock price could continue to rise.

Understanding US Companies with Preferred S? new york stock exchange