In the dynamic world of finance, understanding the market capitalization (market cap) of US stocks is crucial for investors and analysts alike. Market cap is a fundamental measure that reflects the total value of a company. This article delves into what market cap means, how it is calculated, and why it matters in the context of US stocks.

What is Market Cap?

Market capitalization is the total value of all the shares of a company's stock. It's calculated by multiplying the number of outstanding shares by the current market price of each share. This figure provides an indicator of the company's size and potential market influence.

Calculating Market Cap

To calculate a company's market cap, you simply multiply the number of shares outstanding by the current stock price. For instance, if a company has 100 million shares outstanding and the stock is trading at

Types of Market Cap

Market cap can be categorized into three main types:

- Micro-Cap Stocks: These are companies with a market cap of less than $300 million.

- Small-Cap Stocks: Companies with a market cap between

300 million and 2 billion fall into this category. - Mid-Cap Stocks: Market caps for mid-cap companies range from

2 billion to 10 billion. - Large-Cap Stocks: These are the largest companies, with market caps of over $10 billion.

- Megacap Stocks: Companies with market caps exceeding $100 billion are considered megacaps.

Why Does Market Cap Matter?

Understanding a company's market cap is essential for several reasons:

- Investment Decisions: Market cap helps investors decide which stocks to buy or sell. Larger market caps often indicate more stable companies, while smaller caps might present higher risk and reward opportunities.

- Mergers and Acquisitions: Market cap is a critical factor in mergers and acquisitions. Companies often target other companies within their market cap range.

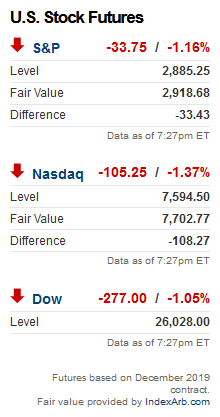

- Indexing: The S&P 500 index, for instance, consists of companies with a large market cap, providing a benchmark for investors.

- Regulatory Requirements: Some regulatory requirements, like the listing standards on exchanges, are based on market cap.

Case Studies

- Apple (AAPL): As one of the largest companies in the world, Apple has a market cap of over $2 trillion. This signifies its immense size and market influence.

- Tesla (TSLA): Despite its relatively short existence, Tesla has achieved a market cap of over $600 billion, reflecting the significant impact of its disruptive technology.

Conclusion

In conclusion, understanding the market cap of US stocks is crucial for investors, analysts, and companies. It provides insight into the size, stability, and potential of a company. By analyzing market cap, investors can make informed decisions and understand the broader context of the stock market.

Unleash Your Trading Potential with the Ult? new york stock exchange