The US stock market has always been a hotbed of opportunities and challenges. As investors, understanding the market trends and making informed decisions is crucial. In this article, we delve into the insights and predictions provided by Inertia7, a leading stock market analysis firm. By analyzing historical data and current market conditions, Inertia7 offers valuable insights that can help investors navigate the complex landscape of the US stock market.

Understanding Inertia7's Approach

Inertia7 employs a comprehensive approach to stock market analysis, incorporating various factors such as economic indicators, company fundamentals, and technical analysis. Their team of experts leverages advanced analytical tools to provide accurate and timely insights. By considering these diverse perspectives, Inertia7 aims to offer a holistic view of the market, enabling investors to make well-informed decisions.

Market Trends and Predictions

One of the key insights from Inertia7's analysis is the current trend of increased volatility in the US stock market. This volatility can be attributed to several factors, including geopolitical uncertainties, economic fluctuations, and technological advancements. As such, Inertia7 predicts that the market will continue to experience ups and downs in the near future.

Sector Analysis

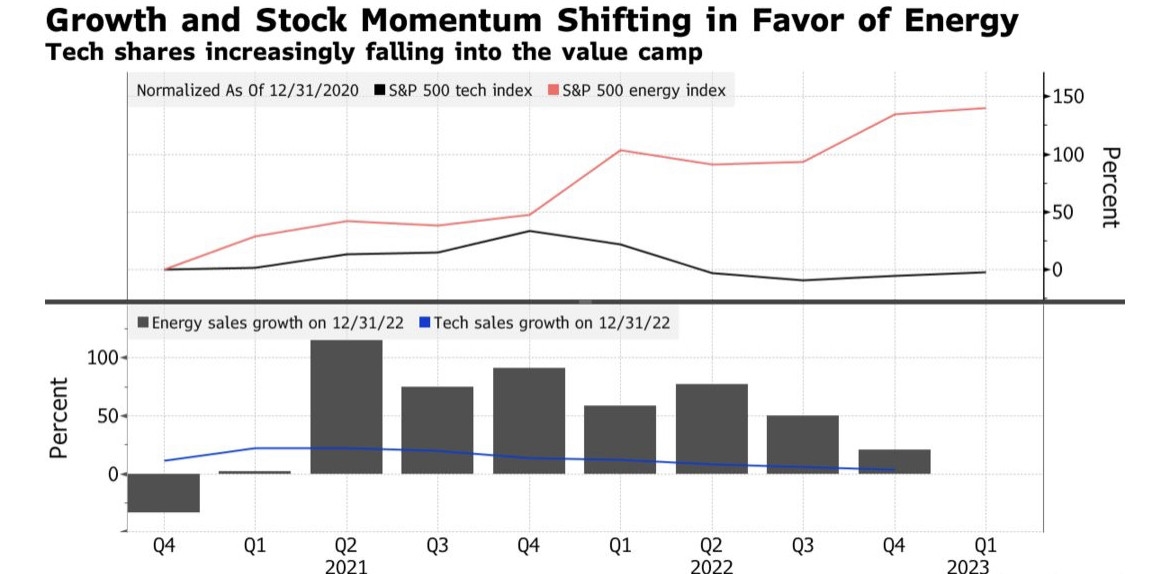

In terms of sector analysis, Inertia7 identifies several key sectors that are poised for growth. The technology sector, driven by innovations in artificial intelligence, cloud computing, and cybersecurity, is expected to witness significant growth. Additionally, the healthcare and energy sectors are also likely to perform well, due to increasing demand and technological advancements.

Company Analysis

Inertia7's analysis also focuses on individual companies, providing in-depth insights into their fundamentals and potential for growth. For example, they recently highlighted Apple Inc. (AAPL) as a strong investment opportunity. The company's strong financial performance, diverse product portfolio, and growing market share make it a compelling choice for investors.

Case Study: Tesla Inc. (TSLA)

A prime example of Inertia7's analysis is their recent report on Tesla Inc. (TSLA). The report, which analyzed the company's fundamentals and market position, concluded that Tesla is well-positioned for future growth. Despite facing challenges such as supply chain disruptions and increased competition, Inertia7's analysis highlighted Tesla's strong brand value, innovative technology, and growing customer base as key factors contributing to its long-term success.

Conclusion

Inertia7's US stock market analysis provides valuable insights that can help investors navigate the complex landscape of the market. By considering various factors such as market trends, sector analysis, and individual company fundamentals, investors can make informed decisions and potentially achieve higher returns. As the market continues to evolve, staying informed and adapting to new trends will be crucial for success.

Chinese AI Company DeepSeek's Low-Cost? new york stock exchange