Preferred stock is a popular investment choice for many investors due to its unique combination of characteristics that can offer both stability and potential growth. In this article, we will delve into the world of US companies with preferred stock, exploring what it is, how it works, and why it might be an attractive option for investors.

What is Preferred Stock?

Preferred stock is a type of equity security that gives shareholders certain privileges over common stockholders. While preferred shareholders do not have voting rights, they are typically entitled to receive dividends before common shareholders and have a higher claim on the company's assets in the event of liquidation.

Key Features of Preferred Stock

Dividends: One of the main attractions of preferred stock is its fixed dividend payments. These dividends are usually higher than those of common stock and are paid out before common dividends. This can provide investors with a stable income stream.

Priority: In the event of a liquidation, preferred shareholders have a higher claim on the company's assets than common shareholders. This means that they are more likely to receive their investment back before common shareholders.

Liquidity: While preferred stock is not as liquid as common stock, it is generally more liquid than bonds. This means that investors can buy and sell preferred stock more easily than they can bonds.

Why Invest in US Companies with Preferred Stock?

Income: For investors seeking a stable income, preferred stock can be an attractive option. The fixed dividend payments can provide a reliable source of income, especially for retirees.

Risk: Preferred stock is generally considered to be less risky than common stock. This is because preferred shareholders have a higher claim on the company's assets and are entitled to receive dividends before common shareholders.

Potential Growth: While preferred stock does not offer the same potential for growth as common stock, it can still provide some growth potential. This is particularly true for companies with a strong financial position and a history of increasing dividends.

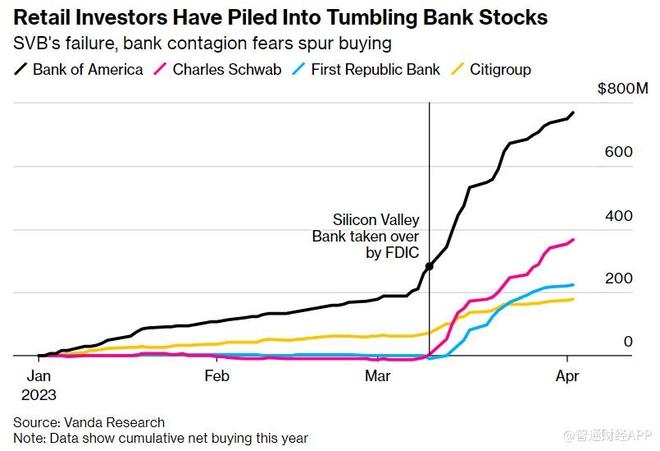

Case Study: Bank of America

One example of a US company with preferred stock is Bank of America. The bank offers several different series of preferred stock, each with its own set of terms and conditions. For instance, Bank of America Series A Preferred Stock (BAC.PA) offers a fixed dividend rate of 5.625% and has a par value of $25.

Conclusion

Preferred stock can be a valuable investment for investors seeking a stable income and lower risk. By understanding the key features and benefits of preferred stock, investors can make informed decisions about where to allocate their investments. Whether you're a seasoned investor or just starting out, preferred stock is worth considering as part of your investment strategy.

Title: S&P US Floating Rate Preferr? new york stock exchange