In today's dynamic market, investors are always on the lookout for promising sectors to invest in. The energy sector, in particular, has seen significant growth in recent years, making it a hot topic among investors. One aspect that investors often focus on is the valuation of energy stocks. This article delves into the US energy stock valuation and provides valuable insights for potential investors.

Understanding US Energy Stock Valuation

Energy stocks are shares of companies that operate in the energy sector, such as oil and gas, renewable energy, and utilities. To determine the valuation of these stocks, investors use various methods, including the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield.

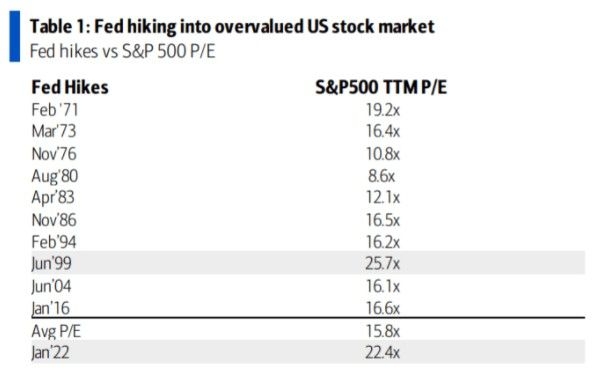

The P/E ratio is a widely used valuation metric that compares a company's stock price to its earnings per share (EPS). A lower P/E ratio generally indicates that the stock is undervalued, while a higher P/E ratio suggests that the stock may be overvalued.

The P/B ratio compares a company's stock price to its book value per share, which is the company's net assets divided by the number of outstanding shares. A P/B ratio below 1 may indicate that the stock is undervalued, while a ratio above 1 may suggest that the stock is overvalued.

The dividend yield measures the annual dividend payment as a percentage of the stock's current market price. A higher dividend yield can be attractive to income-seeking investors.

Key Factors Influencing US Energy Stock Valuation

Several factors can influence the valuation of US energy stocks:

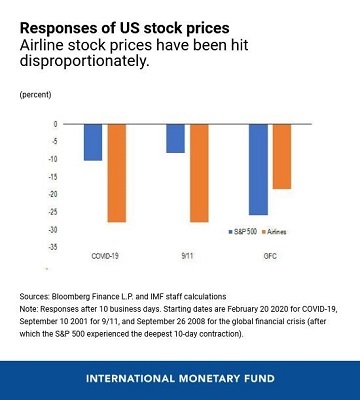

Market Conditions: The overall economic climate, interest rates, and geopolitical events can impact energy stock valuations. For instance, a strong economy and low interest rates can lead to higher energy demand and, consequently, higher stock prices.

Supply and Demand: Changes in oil and gas production, renewable energy adoption, and energy consumption patterns can affect energy stock valuations. An increase in renewable energy usage, for example, could positively impact stocks in that sector.

Company Performance: A company's financial health, including its revenue growth, profitability, and dividend payments, can influence its stock valuation.

Technological Advancements: Innovations in energy technologies can create new opportunities for energy companies, leading to potential stock price increases.

Case Study: ExxonMobil

To illustrate the impact of valuation metrics on energy stocks, let's consider the case of ExxonMobil, one of the largest oil and gas companies in the world.

As of the latest data, ExxonMobil has a P/E ratio of 15.3, a P/B ratio of 1.3, and a dividend yield of 2.3%. Comparing these metrics to industry averages, ExxonMobil appears to be undervalued, as the industry's P/E ratio is around 20, P/B ratio is around 1.5, and dividend yield is around 2%.

This indicates that ExxonMobil may be a good investment opportunity for investors seeking a stable dividend and long-term growth potential.

Conclusion

In conclusion, understanding the valuation of US energy stocks is crucial for investors looking to invest in this sector. By analyzing metrics like P/E ratio, P/B ratio, and dividend yield, investors can gain valuable insights into the potential risks and rewards of energy stocks. As the energy sector continues to evolve, staying informed about market trends and company performance will be key to successful investments.

In-Depth Analysis of FRBK.O: A Look into Fr? new york stock exchange