In the dynamic world of investing, small cap US stocks often offer significant potential for growth and high returns. However, identifying the right opportunities can be challenging. This article delves into the upcoming catalysts that could propel small cap US stocks to new heights. By understanding these factors, investors can make informed decisions and capitalize on the market's next big moves.

1. Technological Advancements

Technology is a key driver of growth in the small cap US stock market. Innovations in areas such as artificial intelligence, blockchain, and biotechnology are creating new opportunities for companies to disrupt traditional industries. For instance, Aeroflex Inc. (ARX), a small cap stock in the aerospace and defense sector, has been benefiting from the growing demand for advanced communication systems.

2. Economic Recovery

The ongoing economic recovery, particularly in the United States, is expected to boost small cap stocks. As the economy continues to improve, companies with strong fundamentals and growth potential are likely to outperform. Lululemon Athletica Inc. (LULU), a small cap stock in the retail sector, has seen a surge in sales as consumers return to pre-pandemic spending levels.

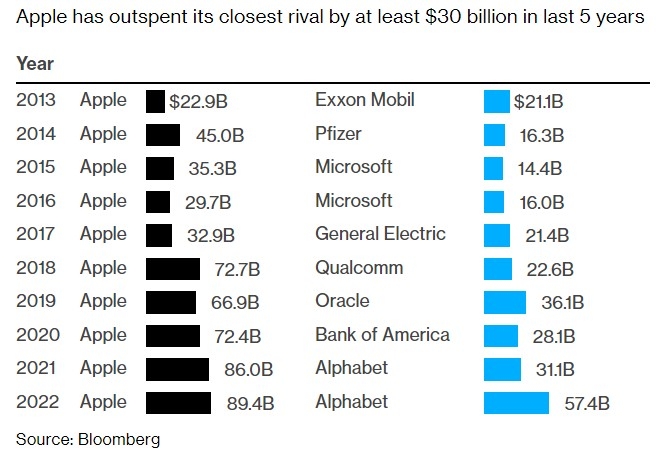

3. Mergers and Acquisitions

Mergers and acquisitions (M&A) activity can be a significant catalyst for small cap stocks. When larger companies acquire smaller ones, it often leads to increased market share, improved profitability, and enhanced growth prospects. Sarepta Therapeutics Inc. (SRPT), a small cap biotechnology company, was acquired by Biogen Inc. (BIIB) in a deal valued at $8.7 billion, providing a substantial boost to SRPT's stock price.

4. Regulatory Changes

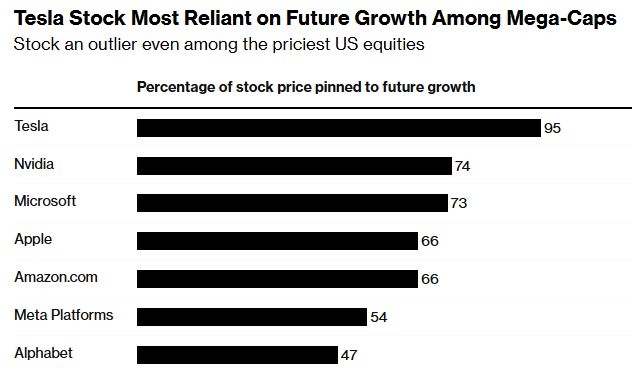

Regulatory changes can have a significant impact on small cap stocks. For instance, changes in tax policies, trade agreements, and environmental regulations can create both opportunities and challenges for companies. Tesla Inc. (TSLA), a small cap stock in the electric vehicle sector, has been benefiting from favorable regulatory policies in the United States and other countries.

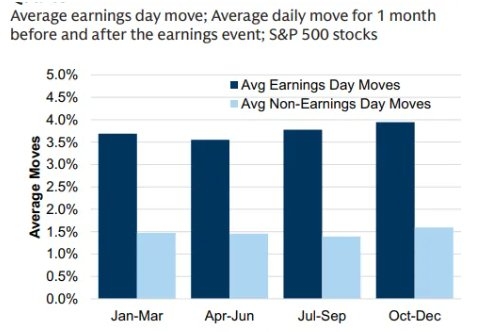

5. Earnings Growth

Earnings growth is a critical factor for small cap stocks. Companies with strong revenue and profit growth tend to attract investor attention and outperform the market. Canaan Inc. (CAN), a small cap stock in the semiconductor sector, has seen its earnings grow significantly over the past few years, driven by strong demand for its products.

6. Sector Rotation

Sector rotation can also be a catalyst for small cap stocks. As investors shift their focus from one sector to another, small cap stocks in the favored sectors can see significant outperformance. For example, NVIDIA Corporation (NVDA), a small cap stock in the technology sector, has seen its stock price soar as investors have shifted their focus from traditional sectors like energy and financials.

In conclusion, small cap US stocks offer exciting opportunities for investors looking to achieve high returns. By keeping an eye on these upcoming catalysts, investors can identify promising small cap stocks and capitalize on the market's next big moves. Whether it's technological advancements, economic recovery, M&A activity, regulatory changes, earnings growth, or sector rotation, these factors can drive significant growth in small cap US stocks.

AMD US Stock Price: Trends, Analysis, and F? us stock market today live cha