In the ever-evolving world of investments, investors are constantly seeking opportunities that offer the potential for high returns. Two popular options that often come to mind are emerging markets and U.S. stocks. But which one is the better choice? This article delves into a comprehensive analysis of both, highlighting their unique characteristics and potential risks.

Understanding Emerging Markets

Emerging markets refer to developing countries that are experiencing rapid economic growth. These countries often have a growing middle class, increasing urbanization, and improving infrastructure. Some of the key emerging markets include China, India, Brazil, and South Africa.

Advantages of Emerging Markets

- High Growth Potential: Emerging markets tend to have higher growth rates compared to developed markets. This is due to factors such as population growth, urbanization, and technological advancements.

- Attractive Valuations: Many emerging market companies are undervalued compared to their U.S. counterparts. This provides investors with the opportunity to buy stocks at a lower price-to-earnings ratio.

- Diversification: Investing in emerging markets can help diversify your portfolio and reduce exposure to market risks.

Disadvantages of Emerging Markets

- Political and Economic Risks: Emerging markets are often characterized by political instability, corruption, and economic volatility. These factors can negatively impact investment returns.

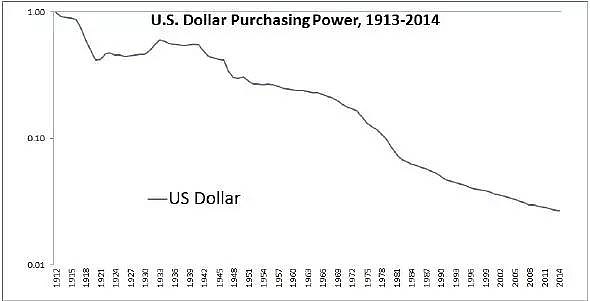

- Currency Risk: Many emerging market currencies are not as stable as the U.S. dollar. This can lead to significant losses if the currency depreciates against the dollar.

- Inadequate Infrastructure: Some emerging markets lack adequate infrastructure, which can hinder economic growth and investment returns.

Understanding U.S. Stocks

U.S. stocks refer to shares of companies listed on American stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. The U.S. stock market is the largest and most developed in the world, with a wide range of companies across various industries.

Advantages of U.S. Stocks

- Stable Economic Environment: The U.S. has a stable political and economic environment, which provides a favorable environment for businesses to grow and investors to earn returns.

- Strong Regulatory Framework: The U.S. has a robust regulatory framework that protects investors and ensures fair and transparent markets.

- Diverse Range of Companies: The U.S. stock market offers a wide range of companies across various industries, providing investors with numerous investment opportunities.

Disadvantages of U.S. Stocks

- High Valuations: Many U.S. stocks are currently overvalued, which may lead to lower returns in the long term.

- Market Risk: The U.S. stock market is subject to market risks, such as economic downturns and geopolitical tensions.

- Diversification Limitations: Investing solely in U.S. stocks may limit your portfolio's diversification and expose you to specific market risks.

Case Studies

To illustrate the differences between emerging markets and U.S. stocks, let's consider two case studies:

China: China has been a major emerging market for several decades. While it offers high growth potential, it also comes with significant political and economic risks. For example, the Chinese government's recent crackdown on tech companies has caused concern among investors.

Apple (AAPL): Apple is a well-known U.S. stock that has consistently delivered strong returns over the years. However, its high valuations and exposure to market risks have raised concerns among some investors.

Conclusion

In conclusion, both emerging markets and U.S. stocks offer unique opportunities and risks. Investors should carefully consider their investment goals, risk tolerance, and market conditions before making a decision. By diversifying their portfolios and staying informed, investors can maximize their chances of achieving long-term success.

Can You Invest in US Stocks in the UK?? us stock market today live cha