Are you looking to diversify your investment portfolio and explore the potential of US stocks? If so, you might be wondering if it's possible to invest in US stocks from the UK. The answer is a resounding yes! Investing in US stocks from the UK has become increasingly accessible and appealing for investors seeking growth opportunities in the world's largest economy. This article will delve into the process, advantages, and potential pitfalls of investing in US stocks from the UK.

Understanding the Process

To invest in US stocks from the UK, you'll need to open a brokerage account with a firm that allows international trading. There are several reputable online brokers that offer this service, including TD Ameritrade, E*TRADE, and Fidelity. Once you've opened an account, you'll need to fund it with pounds (GBP) and convert them to US dollars (USD) to purchase US stocks.

Advantages of Investing in US Stocks from the UK

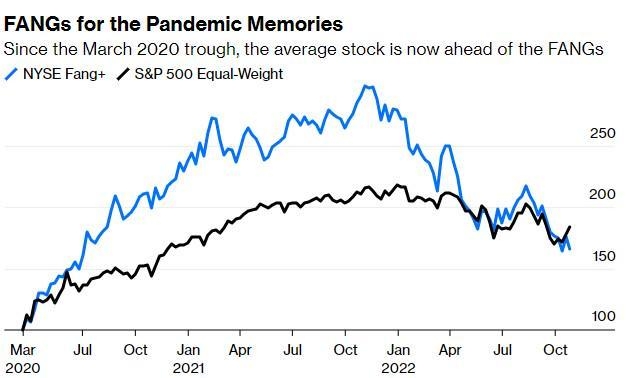

Diversification: Investing in US stocks can provide a valuable source of diversification for your portfolio, particularly if you're already invested in UK markets. The US market often performs differently from the UK, which can help mitigate risks.

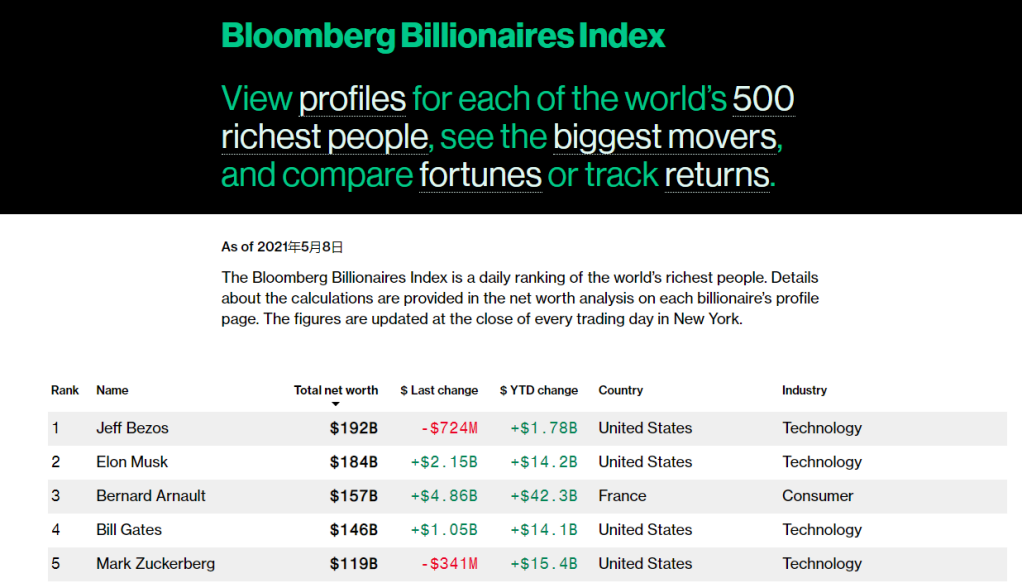

Growth Opportunities: The US stock market is known for its innovation and technological advancements. By investing in US stocks, you can gain exposure to leading companies in sectors like technology, healthcare, and consumer goods.

Market Size: The US stock market is the largest in the world, offering a wide range of investment opportunities across various sectors and industries.

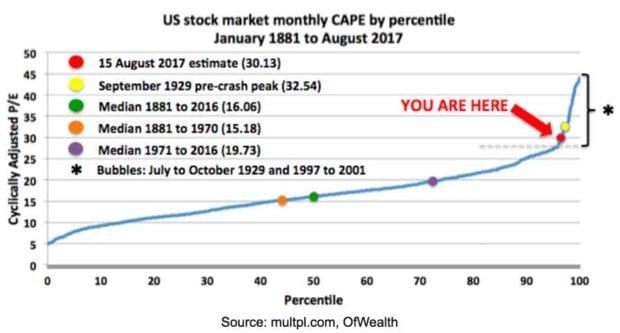

Historical Performance: Historically, the US stock market has provided strong returns over the long term. Investing in US stocks can be a way to capitalize on this historical performance.

Considerations and Potential Pitfalls

Currency Fluctuations: Investing in US stocks from the UK means you'll be exposed to currency exchange rates. Fluctuations in the GBP/USD exchange rate can impact your returns, both positively and negatively.

Tax Implications: While UK investors are subject to capital gains tax on profits from UK stocks, there may be additional tax considerations when investing in US stocks. It's essential to consult with a tax professional to understand the potential tax implications.

Trading Costs: When trading US stocks, you'll need to consider the cost of currency conversion, brokerage fees, and potential transaction fees. These costs can impact your overall returns.

Case Studies

Let's look at a few case studies to illustrate the potential benefits of investing in US stocks from the UK:

Amazon: Since its inception, Amazon has become one of the world's most valuable companies. An investor who purchased shares of Amazon when it went public in 1997 and reinvested dividends could have seen a substantial return on their investment.

Apple: Apple has been a top performer in the US stock market for years. An investor who bought shares of Apple when it first became available on the market could have seen significant growth in their investment.

Tesla: Tesla has seen rapid growth since its inception, and its shares have become highly sought-after. An early investor in Tesla could have seen a substantial return on their investment.

Conclusion

Investing in US stocks from the UK can be a valuable strategy for diversifying your investment portfolio and capitalizing on growth opportunities in the world's largest economy. While there are potential risks and considerations to keep in mind, the potential benefits can be significant. Before diving into the market, it's crucial to do thorough research and consider your investment goals and risk tolerance.

Is the US Stock Market Open? Understanding ? new york stock exchange