In today's volatile job market, it's essential to understand how your salary stacks up against the stock market. Many Americans wonder if they're being compensated fairly compared to the potential returns they could earn from investing in the stock market. This article delves into a comprehensive comparison of salaries in the United States to the stock market, providing valuable insights for both employees and investors.

Understanding Salary Trends

Salaries in the United States have been growing at a moderate pace over the past few years. According to the U.S. Bureau of Labor Statistics, the average annual wage in the U.S. was approximately $52,946 as of May 2020. However, it's important to note that this figure can vary significantly based on factors such as industry, experience, and location.

The Stock Market: A Dynamic Investment Landscape

On the other hand, the stock market offers a world of opportunities for investment. While it's true that the stock market can be unpredictable and volatile, it also has the potential to provide substantial returns over the long term. The S&P 500, a widely followed index that tracks the performance of 500 large companies, has historically provided an average annual return of around 10% since its inception in 1923.

Comparing Salaries to Stock Market Returns

To compare salaries to stock market returns, let's take a look at a hypothetical scenario. Suppose you're an employee earning the average annual salary of $52,946. If you were to invest a portion of your income in the stock market, you might consider the following:

Long-Term Investing: Investing in the stock market for the long term can offer substantial returns. For example, if you invested

5,000 per year for 30 years with an average annual return of 10%, you would accumulate approximately 1,068,675, assuming you reinvested dividends and did not add any additional money.Short-Term Investing: While short-term investing can be riskier, it may also offer higher returns. For instance, if you invested

5,000 per year for 10 years with an average annual return of 10%, you would accumulate approximately 815,920.

Factors to Consider

When comparing salaries to stock market returns, it's important to consider several factors:

Risk Tolerance: Your risk tolerance will influence your investment strategy. Generally, higher risk investments have the potential for higher returns, but they also come with a greater chance of loss.

Investment Strategy: Your investment strategy, including the types of stocks or funds you choose, can significantly impact your returns.

Tax Implications: Taxes can have a significant impact on your investment returns. It's essential to understand the tax implications of your investment strategy.

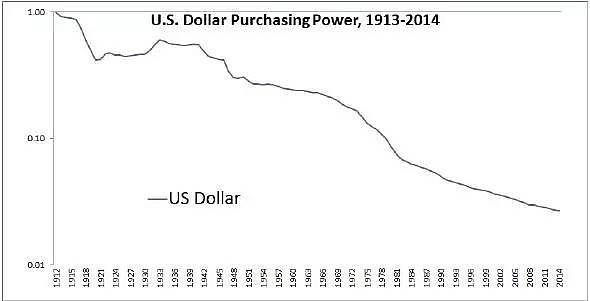

Inflation: Inflation can erode the purchasing power of your salary and investments. It's important to factor this into your financial planning.

Conclusion

While comparing salaries to stock market returns can be a complex task, it's crucial to understand the potential of both. As an employee, you should focus on maximizing your salary while also considering the potential returns from investing in the stock market. By understanding the dynamics of both, you can make informed decisions that align with your financial goals and risk tolerance.

Title: US Stock Market Time: Understanding ? us stock market today live cha