In the world of stock trading, volatility can be a double-edged sword. For investors, it can mean significant gains or devastating losses. One stock that has been a subject of much discussion in terms of volatility is Apple Inc. (AAPL). This article aims to delve into the factors contributing to the volatility of AAPL's US stock and its implications for investors.

Understanding AAPL Stock Volatility

Apple Inc., often simply referred to as Apple, is one of the largest and most influential companies in the world. Its stock has been known for its high volatility, which can be attributed to several factors.

1. Market Sentiment

One of the primary reasons for the volatility of AAPL stock is market sentiment. The tech giant is often seen as a bellwether for the entire tech industry, and any news or rumors about the company can cause significant fluctuations in its stock price. For instance, a positive product launch or earnings report can lead to a surge in the stock price, while negative news or a failed product launch can result in a sharp decline.

2. Economic Factors

Economic factors also play a significant role in the volatility of AAPL stock. As a global company, Apple's performance is affected by economic conditions worldwide. Factors such as inflation, interest rates, and currency fluctuations can impact the company's revenue and, consequently, its stock price.

3. Supply Chain Issues

Apple's supply chain has been a source of concern for investors in recent years. The company relies heavily on suppliers, particularly in China, for its products. Any disruptions in the supply chain, such as trade tensions or factory shutdowns, can lead to delays in product launches and, ultimately, affect the stock price.

4. Competition

The tech industry is highly competitive, and Apple faces stiff competition from companies like Samsung, Huawei, and others. Any new product launch or innovation from a competitor can impact Apple's market share and, subsequently, its stock price.

Case Studies: AAPL Stock Volatility in Action

Let's take a look at a few examples of AAPL stock volatility in action.

1. iPhone Launches

One of the most significant events that can cause volatility in AAPL stock is the launch of a new iPhone. For instance, the launch of the iPhone 12 in 2020 saw a surge in the stock price, as investors were excited about the new features and potential sales. However, the stock price took a hit when the company reported supply chain disruptions due to the COVID-19 pandemic.

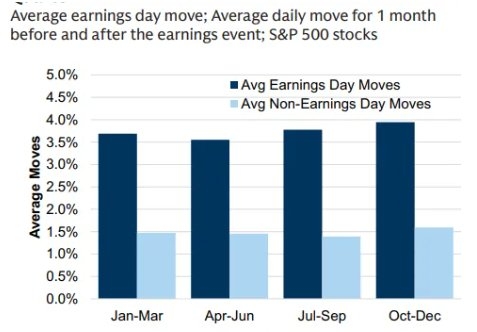

2. Earnings Reports

Apple's earnings reports are another event that can cause significant volatility in the stock price. For instance, in April 2021, the company reported better-than-expected earnings, leading to a surge in the stock price. However, the stock price took a hit a few months later when the company reported lower-than-expected revenue for the following quarter.

In conclusion, AAPL US stock volatility is influenced by a variety of factors, including market sentiment, economic conditions, supply chain issues, and competition. Understanding these factors can help investors make informed decisions and manage their risk effectively.

Micro Cap Stocks Market Cap Under $300 Mill? us stock market today live cha