Are you interested in investing in ASML, the world-renowned semiconductor equipment manufacturer? If so, you've come to the right place. This article will guide you through the process of buying ASML stock in the US, from researching the company to executing your trade. Let's dive in.

Understanding ASML

Before you start investing, it's essential to understand the company you're investing in. ASML, short for the Dutch company ASM International, is a leader in the semiconductor industry. The company provides innovative solutions for manufacturing microchips and has a significant market share in the industry.

1. Research ASML's Financials

To make an informed investment decision, you need to research ASML's financials. Look at the company's revenue, earnings, and cash flow. Analyze its financial statements, such as the income statement, balance sheet, and cash flow statement. This will give you a better understanding of ASML's financial health and potential growth prospects.

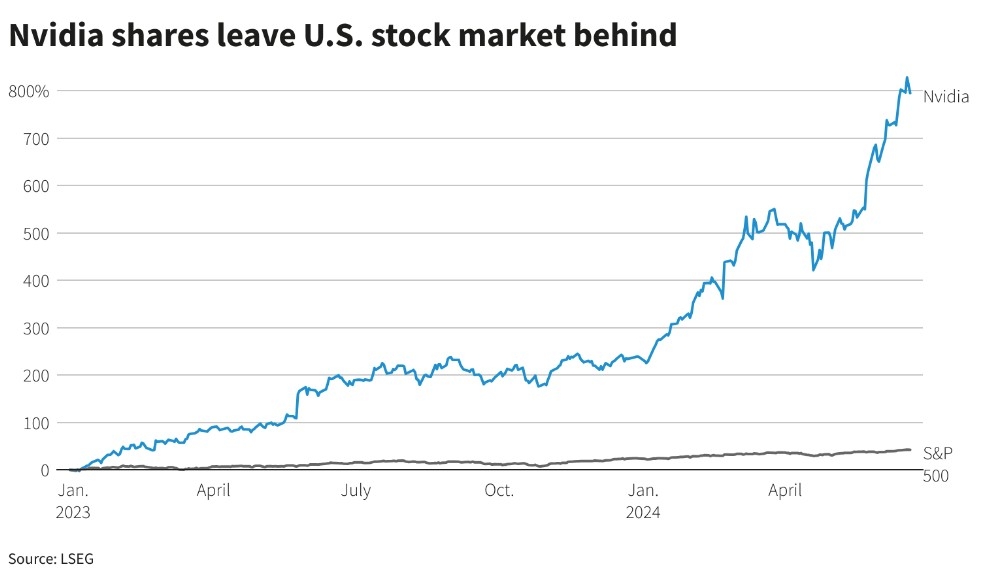

2. Assess the Semiconductor Industry

Investing in ASML means investing in the semiconductor industry. To evaluate the industry's performance, consider factors such as demand for semiconductors, technological advancements, and competition. Additionally, keep an eye on the global economy and geopolitical events that could impact the industry.

3. Choose a Brokerage Account

To buy ASML stock, you'll need a brokerage account. There are several online brokers to choose from, each offering different fees, trading platforms, and services. Consider the following factors when choosing a brokerage:

- Fees: Look for a broker with low trading fees and no hidden costs.

- Trading Platform: Choose a platform that is user-friendly and offers the tools and resources you need for research and analysis.

- Customer Service: Make sure the broker provides reliable customer support to assist you with any issues or questions.

4. Open Your Brokerage Account

Once you've chosen a brokerage, follow these steps to open your account:

- Sign up: Visit the brokerage website and complete the sign-up process.

- Provide Information: You will need to provide personal information, including your name, address, and social security number.

- Fund Your Account: Transfer funds from your bank account to your brokerage account to have the necessary capital for your investment.

5. Research ASML Stock

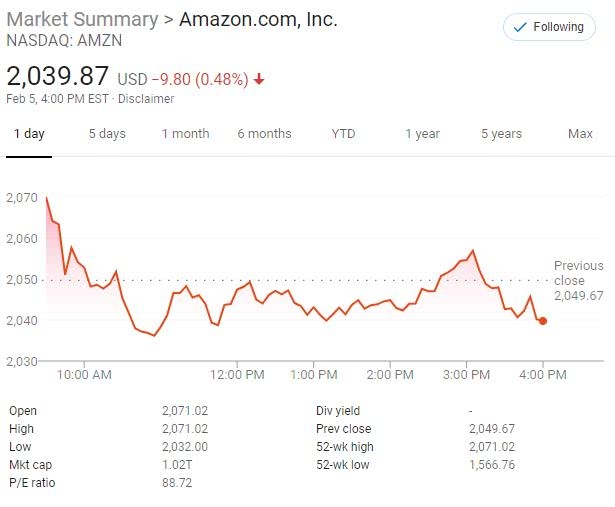

Before placing your order, research ASML stock. Look at its historical price chart, technical indicators, and any news or developments that could impact its share price. Some key factors to consider include:

- Price-to-Earnings (P/E) Ratio: This ratio compares the company's current stock price to its per-share earnings.

- Price-to-Book (P/B) Ratio: This ratio compares the company's stock price to its book value.

- Dividend Yield: This indicates the percentage of a company's earnings distributed as dividends.

6. Place Your Order

Now that you've done your research, it's time to place your order. Follow these steps:

- Log in to Your Brokerage Account: Access your brokerage account and navigate to the trading platform.

- Enter Your Order: Enter the number of shares you wish to buy, the price you're willing to pay, and the type of order (e.g., market order or limit order).

- Review and Confirm: Double-check your order details, then confirm your trade.

7. Monitor Your Investment

Once you've bought ASML stock, it's essential to monitor your investment. Keep an eye on the company's financials, the semiconductor industry, and global economic events. Consider setting up price alerts to notify you of significant changes in the stock price.

By following these steps, you can successfully buy ASML stock in the US. Remember to do your research, invest wisely, and stay informed about the market. Happy investing!

Largest US Defense Stocks: A Deep Dive into? us stock market today live cha