In the vast world of financial markets, crude oil stock prices play a pivotal role. For investors, understanding the factors that influence these prices is crucial for making informed decisions. This article delves into the intricacies of US crude oil stock prices, exploring the factors that drive them and providing insights into how they can be analyzed. By the end, you'll have a clearer understanding of what impacts the value of these stocks and how to interpret market trends.

The Basics of Crude Oil Stock Prices

Crude oil stock prices refer to the value assigned to shares of companies involved in the exploration, production, and distribution of crude oil. These prices fluctuate based on various market conditions, including supply and demand, geopolitical events, and economic factors.

Supply and Demand Dynamics

The most fundamental factor influencing crude oil stock prices is the balance between supply and demand. When demand for oil is high and supply is low, prices tend to rise. Conversely, an oversupply of oil can lead to price decreases. Key factors that affect supply and demand include:

- Production Levels: The amount of crude oil being extracted from wells around the world.

- Consumer Demand: The amount of oil consumed by industrial, commercial, and residential sectors.

- Economic Growth: A strong global economy typically increases oil demand, whereas a slowdown can reduce it.

Geopolitical Events

Geopolitical events, such as conflicts in oil-producing regions or changes in trade agreements, can have a significant impact on crude oil stock prices. For example, disruptions in production due to geopolitical tensions in the Middle East can lead to higher prices, while new trade deals can stabilize or even lower prices.

Economic Factors

Economic indicators and trends also play a crucial role in determining crude oil stock prices. These include:

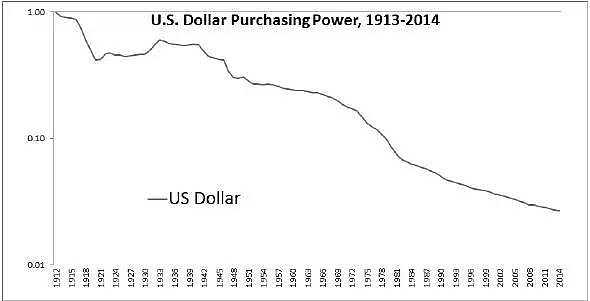

- Inflation: Higher inflation can lead to increased demand for oil as it becomes more expensive in real terms.

- Currency Fluctuations: Since crude oil is often priced in U.S. dollars, changes in the value of the dollar can impact prices.

- Interest Rates: Higher interest rates can make borrowing more expensive, potentially reducing oil consumption.

Analyzing Crude Oil Stock Prices

To effectively analyze crude oil stock prices, investors can use various tools and techniques:

- Technical Analysis: This involves studying past price movements and volume to identify patterns and trends.

- Fundamental Analysis: This focuses on analyzing economic, financial, and political factors that affect the oil industry.

- Market Sentiment: Understanding the overall mood of the market can provide insights into potential price movements.

Case Studies

Let's look at a few recent examples to illustrate how these factors can influence crude oil stock prices:

- 2014 Oil Price Crash: A combination of increased production, a slowdown in global economic growth, and geopolitical tensions led to a significant drop in oil prices.

- 2020 Oil Price War: A dispute between Saudi Arabia and Russia over production levels triggered a rapid decline in prices, reaching historic lows.

Conclusion

Understanding US crude oil stock prices requires a nuanced understanding of market dynamics, geopolitical events, and economic factors. By analyzing these elements, investors can make more informed decisions and potentially capitalize on market opportunities. Whether you're a seasoned investor or just starting out, knowledge is key to navigating the complex world of crude oil stocks.

Us Stock Rebound: A Glimmer of Hope Amidst ? us stock market today