In today's globalized economy, tariffs play a pivotal role in the relationship between international trade and U.S. stocks. As the United States continues to grapple with trade policies, investors are left wondering how tariffs could impact their portfolios. This article delves into the intricate relationship between tariffs and U.S. stocks, highlighting the potential risks and opportunities that arise from these policies.

Understanding Tariffs

Tariffs are taxes imposed on imported goods, designed to protect domestic industries from foreign competition. While they can benefit certain sectors, they often lead to higher prices for consumers and can strain international relations. The Trump administration's trade policies, which included imposing tariffs on various countries, have sparked a heated debate on their impact on the U.S. economy and stock market.

Impact on U.S. Stocks

The impact of tariffs on U.S. stocks is multifaceted. On one hand, tariffs can benefit domestic industries by making foreign goods more expensive. This can lead to increased demand for domestically produced goods, potentially boosting the profits of companies in those sectors. For example, the tariffs on steel imports have been beneficial for U.S. steel producers, such as Nucor Corporation (NUE) and United States Steel Corporation (X).

On the other hand, tariffs can also have a negative impact on U.S. stocks. Higher prices for imported goods can lead to increased inflation, which can erode the purchasing power of consumers. This can ultimately hurt the earnings of companies across various sectors, as consumers may cut back on spending. Additionally, tariffs can lead to trade wars, which can further disrupt global supply chains and economic growth.

Case Study: The Trade War with China

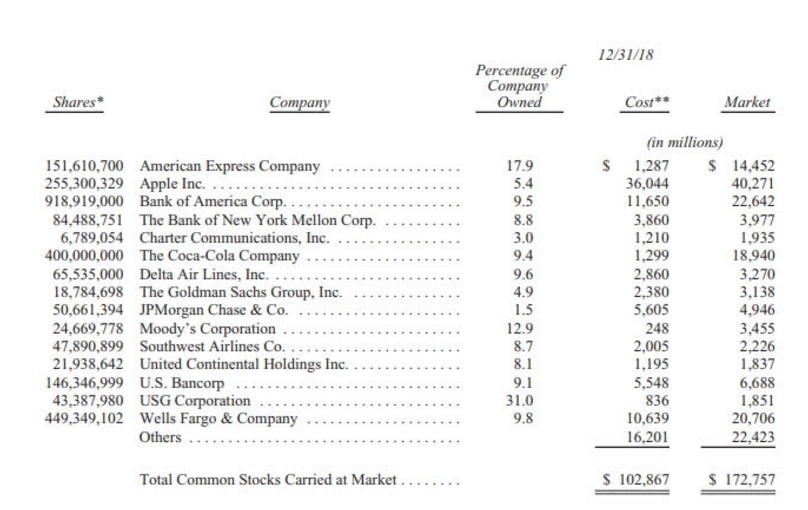

One of the most significant examples of the impact of tariffs on U.S. stocks is the trade war with China. In 2018, the Trump administration imposed tariffs on Chinese goods, leading to a series of retaliatory measures from China. This trade war has had a profound impact on the U.S. stock market, with many investors concerned about the potential long-term consequences.

The technology sector, which is heavily reliant on Chinese imports, has been particularly affected by the trade war. Companies like Apple Inc. (AAPL) and Micron Technology, Inc. (MU) have seen their stocks impacted by the increased costs of manufacturing and the potential for reduced demand for their products in China.

Opportunities and Risks

Despite the potential risks, there are opportunities for investors to benefit from the tariff situation. Some companies have managed to adapt to the new trade environment by diversifying their supply chains or investing in domestic production. For example, companies like Harley-Davidson, Inc. (HOG) have shifted some of their production to the United States to avoid the tariffs on motorcycles imported from other countries.

However, investors need to be cautious and conduct thorough research before investing in companies that may be affected by tariffs. It's essential to consider the potential risks and the long-term impact of these policies on the company's business and the broader economy.

Conclusion

The relationship between tariffs and U.S. stocks is complex and ever-evolving. While tariffs can benefit certain sectors, they also pose significant risks to the broader economy and stock market. As investors navigate this challenging environment, it's crucial to stay informed and make informed decisions based on thorough research and analysis.

Toys "R" Us Stock Associa? us stock market today