In the dynamic world of the stock market, identifying the best performing US stocks is a task that requires both skill and insight. This article delves into the concept of momentum analysis, a powerful tool used by investors to predict the future performance of stocks. We will explore the strategies behind momentum analysis, its relevance in the current market, and provide examples of stocks that have demonstrated strong momentum.

Understanding Momentum Analysis

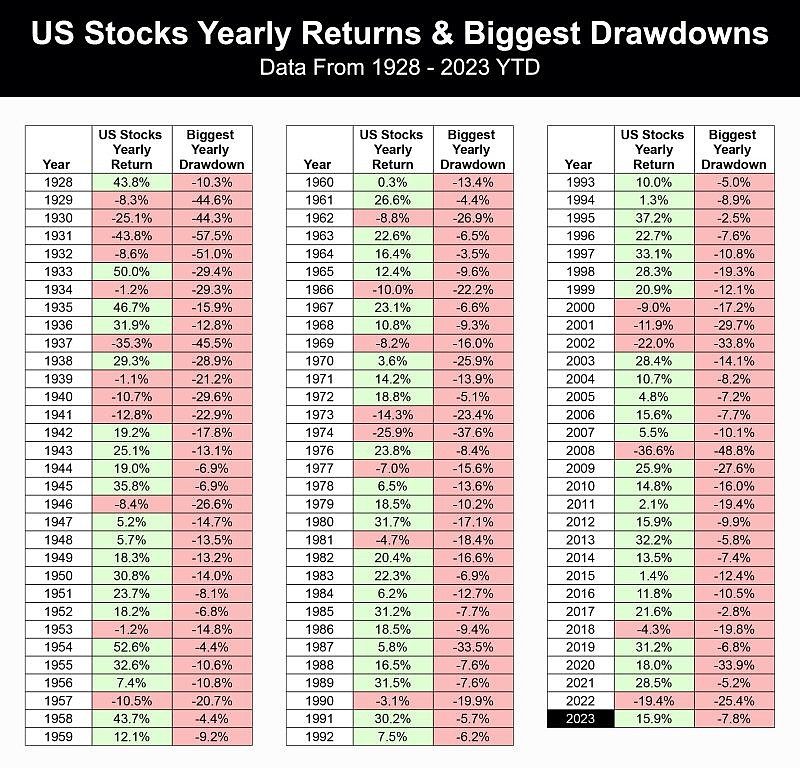

Momentum analysis is a method used to determine the direction of a stock's price movement by examining its past performance. The premise is that stocks with strong momentum are likely to continue their upward trend. By analyzing the speed, magnitude, and duration of price changes, investors can make informed decisions about buying or selling stocks.

Key Factors in Momentum Analysis

Several key factors are considered in momentum analysis:

- Price Trends: Analyzing the historical price trends of a stock helps identify whether it is in an uptrend or downtrend.

- Volume: High trading volume indicates strong interest in a stock, which can be a sign of momentum.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. A reading above 70 suggests overbought conditions, while a reading below 30 indicates oversold conditions.

- Moving Averages: Moving averages help smooth out price data and identify the trend direction.

Current Market Trends

In the current market environment, several stocks have demonstrated strong momentum. Let's take a look at a few examples:

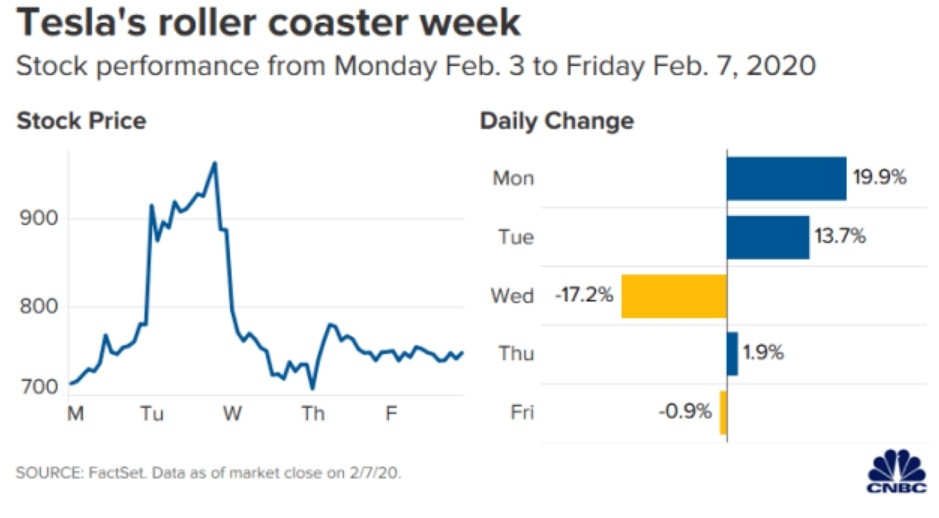

1. Tesla (TSLA) Tesla has been a standout performer in the electric vehicle (EV) industry. The company's innovative products and strong market demand have driven its stock price to new heights. Its impressive growth potential makes it a compelling investment opportunity.

2. NVIDIA (NVDA) NVIDIA is a leader in the semiconductor industry, providing graphics processing units (GPUs) for various applications, including gaming, AI, and autonomous vehicles. The company's strong revenue growth and increasing demand for its products have propelled its stock price higher.

3. Amazon (AMZN) As the world's largest online retailer, Amazon has continued to grow its market share and expand its product offerings. The company's investment in cloud computing through Amazon Web Services (AWS) has also contributed to its impressive stock performance.

Strategies for Implementing Momentum Analysis

To effectively implement momentum analysis, investors can follow these strategies:

- Identify Stocks with Strong Momentum: Use technical indicators like RSI and moving averages to identify stocks with strong momentum.

- Diversify Your Portfolio: Diversify your investments across different sectors and industries to mitigate risk.

- Monitor Market Trends: Stay updated on market trends and news that could impact stock prices.

In conclusion, momentum analysis is a valuable tool for investors looking to identify the best performing US stocks. By understanding the key factors and implementing effective strategies, investors can make informed decisions and potentially achieve significant returns. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Is the US Stock Market Open? Understanding ? us stock market today