Are you considering buying US stocks from the UK? If so, you're not alone. With the rise of global investment opportunities, more and more investors are looking to diversify their portfolios by investing in US stocks. This guide will provide you with all the information you need to know about buying US stocks in the UK, including the process, fees, and potential risks.

Understanding the Process

1. Open a Brokerage Account The first step in buying US stocks from the UK is to open a brokerage account. There are several online brokers that offer services to UK investors, including Fidelity, Charles Schwab, and Interactive Brokers. When choosing a broker, consider factors such as fees, customer service, and the range of investment options available.

2. Fund Your Account Once you have opened a brokerage account, you will need to fund it. You can do this by transferring funds from your UK bank account or by using a credit/debit card. Some brokers may also offer the option to transfer funds via bank wire.

3. Research and Select Stocks Next, research and select the stocks you want to buy. You can use the brokerage platform's research tools to analyze the performance of different stocks and make informed decisions. It's important to conduct thorough research and consider factors such as the company's financial health, industry trends, and market conditions.

4. Place Your Order Once you have selected the stocks you want to buy, you can place your order through the brokerage platform. You can choose to place a market order, which will execute the trade at the current market price, or a limit order, which will execute the trade only at a specific price or better.

Fees and Costs

When buying US stocks from the UK, there are several fees and costs to consider:

- Brokerage Fees: Most brokers charge a fee for each trade you execute. This fee can vary depending on the broker and the type of order you place.

- Stamp Duty: In the UK, you are required to pay stamp duty on shares purchased in the UK. However, if you are purchasing US stocks, you may be exempt from this fee.

- Withholding Tax: When you buy US stocks, you may be subject to withholding tax on any dividends you receive. This tax is usually around 30%, but it can be reduced under certain circumstances.

Risks to Consider

While investing in US stocks can be a lucrative opportunity, it's important to be aware of the risks involved:

- Exchange Rate Risk: The value of the US dollar can fluctuate against the pound, which can impact the value of your investment.

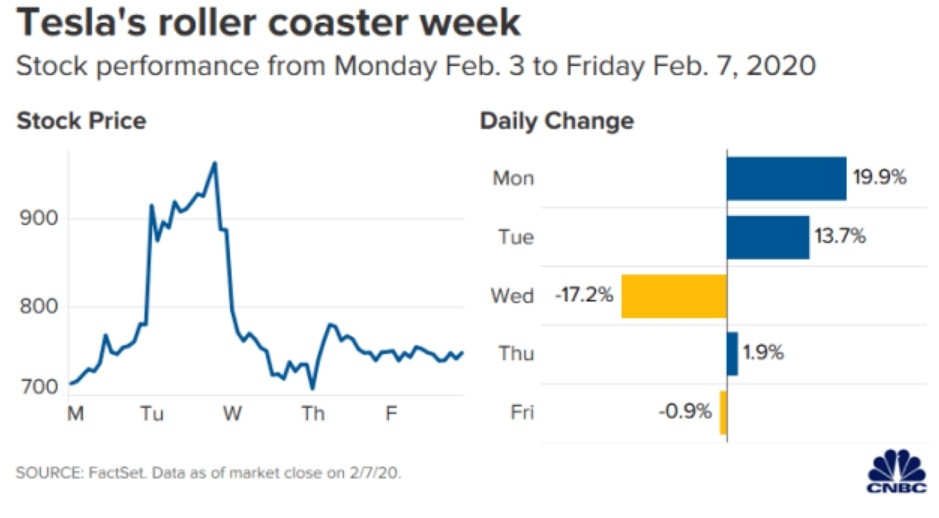

- Market Risk: The stock market can be volatile, and the value of your investment can go up or down.

- Regulatory Risk: Different countries have different regulations and laws governing investments, which can impact your investment.

Case Study: Investing in Apple Stock

Let's say you want to invest in Apple stock. After conducting thorough research, you decide that Apple is a solid investment. You open a brokerage account with a US-based broker, fund your account, and place a market order to buy 100 shares of Apple stock. The current market price is

After a few months, the value of the stock increases to

Buying US stocks from the UK can be a great way to diversify your investment portfolio. By understanding the process, fees, and risks involved, you can make informed decisions and potentially benefit from the growth of the US stock market.

Is the US Stock Market Open? Understanding ? us stock market today