The stock market has been a rollercoaster ride over the past few years, but recently, there's been a glimmer of hope with the US stock rebound. Investors are cautiously optimistic as they see signs of a recovery in the economy and a stabilizing market. In this article, we'll delve into the factors contributing to this rebound and how investors can capitalize on this trend.

Understanding the US Stock Rebound

The US stock market has seen its fair share of ups and downs. However, the recent rebound has been driven by several key factors. One of the main drivers is the improving economic outlook. As the economy starts to pick up steam, companies are reporting better-than-expected earnings, which in turn, boosts investor confidence.

Factors Contributing to the Rebound

Improving Economic Outlook: The US economy has been gradually recovering from the pandemic's impact. Key indicators, such as GDP growth and job creation, have shown promising signs. This has led to increased investor optimism and a subsequent rebound in the stock market.

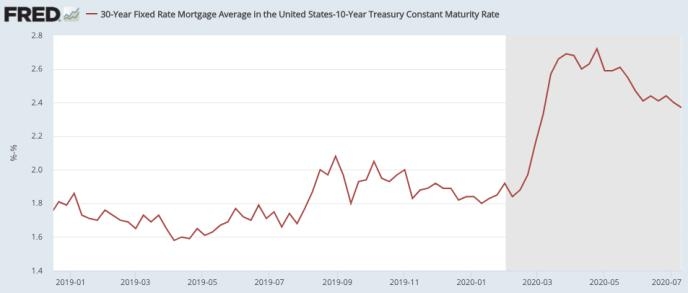

Low Interest Rates: The Federal Reserve has been implementing accommodative monetary policy, which has kept interest rates low. This has made borrowing cheaper and encouraged businesses and consumers to spend, thus supporting economic growth.

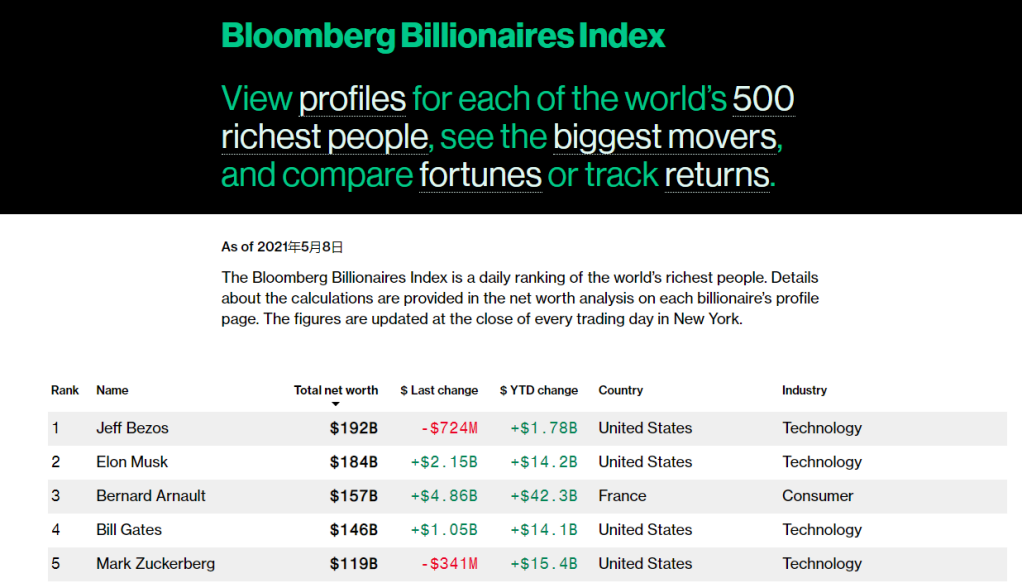

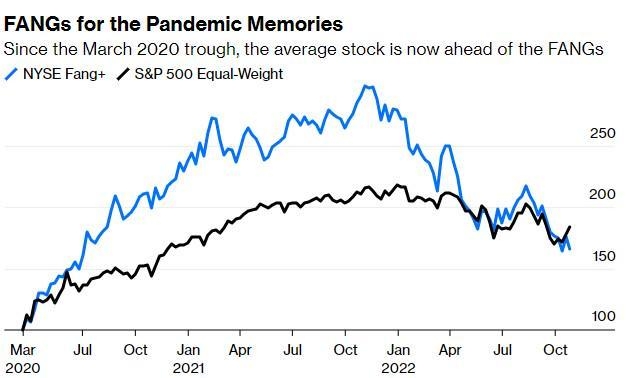

Technological Advancements: The tech sector has been a significant contributor to the stock market's rebound. Companies like Apple, Amazon, and Google have been at the forefront, posting strong earnings and expanding their market presence.

Diversification of the Market: The US stock market has become more diversified over the years, reducing its vulnerability to economic downturns. This diversification has played a crucial role in the market's resilience and subsequent rebound.

Case Studies: Success Stories

Let's take a look at a couple of case studies that highlight the US stock rebound:

Apple Inc.: Apple's stock has seen a remarkable surge over the past few years. This is attributed to its continuous innovation and expansion into new markets, such as services and wearables. Apple's strong financial performance has been a significant factor in the broader market's rebound.

Amazon.com Inc.: Amazon's stock has also experienced a significant rebound, driven by its impressive growth in e-commerce and cloud computing. The company's ability to adapt to changing market trends and leverage technology has been a key factor in its success.

Investing Opportunities

Investors looking to capitalize on the US stock rebound should consider the following strategies:

Diversify Your Portfolio: Diversification can help mitigate risks and capitalize on different market sectors. Consider investing in a mix of stocks, bonds, and other assets.

Focus on Companies with Strong Financials: Look for companies with strong balance sheets, solid earnings growth, and a proven track record of success.

Stay Informed: Keep up with market trends and economic indicators to make informed investment decisions.

Consider Technology Stocks: The technology sector has been a significant driver of the US stock rebound, and it's likely to continue its upward trend.

In conclusion, the US stock rebound presents a promising opportunity for investors. By understanding the factors contributing to this rebound and adopting a well-diversified investment strategy, investors can capitalize on this trend and potentially achieve impressive returns.

Is the US Stock Market Open? Understanding ? new york stock exchange