The relationship between US stock prices and the strength of the dollar is a complex and fascinating topic. Understanding this connection can provide valuable insights into the global financial markets. In this article, we will delve into how US stock prices influence the dollar's value and explore the underlying factors that drive this relationship.

Understanding the Link

The US stock market is one of the largest and most influential in the world. When US stock prices rise, it typically indicates a strong economy and investor confidence. Conversely, falling stock prices can signal economic concerns and a loss of investor confidence. The dollar's value is closely tied to these economic indicators.

Positive Impact of Rising Stock Prices

When US stock prices are on the rise, several factors contribute to the strengthening of the dollar:

Investor Confidence: Higher stock prices boost investor confidence, attracting foreign investors who seek to capitalize on the strong market. This increased demand for US stocks leads to a higher demand for the dollar, driving its value up.

Interest Rates: The Federal Reserve often raises interest rates when the stock market is performing well, as it indicates a strong economy. Higher interest rates make US investments more attractive to foreign investors, further strengthening the dollar.

Economic Growth: Strong stock prices reflect a robust economy, which can lead to increased exports and a trade surplus. This surplus can strengthen the dollar as demand for the US currency increases.

Negative Impact of Falling Stock Prices

Conversely, falling stock prices can have a detrimental effect on the dollar:

Investor Concerns: Declining stock prices can raise concerns about the economy's health, leading to a loss of investor confidence. This can cause foreign investors to withdraw their investments, reducing demand for the dollar and potentially weakening its value.

Interest Rates: The Federal Reserve may lower interest rates in response to falling stock prices and economic concerns. Lower interest rates can make US investments less attractive to foreign investors, potentially leading to a weaker dollar.

Trade Deficits: Falling stock prices can indicate a struggling economy, which can lead to increased imports and a trade deficit. This deficit can put downward pressure on the dollar as the country needs to exchange more dollars for foreign currencies to pay for imports.

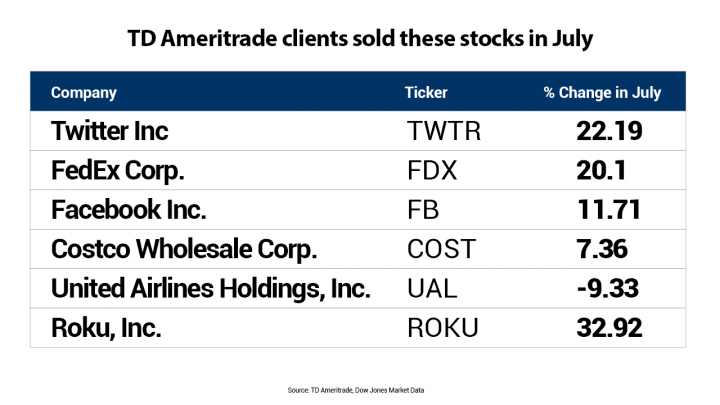

Case Studies

To illustrate the impact of US stock prices on the dollar, let's consider a few case studies:

2008 Financial Crisis: During the 2008 financial crisis, US stock prices plummeted, leading to a significant decline in the dollar's value. The crisis eroded investor confidence and caused the Federal Reserve to lower interest rates, further weakening the dollar.

2020 COVID-19 Pandemic: In early 2020, as the COVID-19 pandemic spread, US stock prices dropped sharply. The Federal Reserve responded by lowering interest rates and implementing various stimulus measures. While the dollar initially weakened, it later stabilized as the economy began to recover and investor confidence improved.

In conclusion, the relationship between US stock prices and the strength of the dollar is a dynamic and interconnected one. Understanding this relationship can help investors and economists better navigate the global financial markets. By keeping a close eye on stock prices, one can gain valuable insights into the health of the US economy and the potential direction of the dollar.

Buying Indian Stocks in the US: A Comprehen? new york stock exchange