Understanding the US Stock Market's Trajectory Over the Past Five Years

In the ever-evolving world of finance, keeping an eye on the US stock market is crucial for investors and market enthusiasts alike. Over the past five years, the stock market has seen its fair share of ups and downs, reflecting both economic stability and market volatility. This article delves into a comprehensive analysis of the US stock market's performance over the past five years, using a 5-year graph to visualize the trajectory.

The Stock Market in Perspective

The stock market is a complex entity, influenced by a multitude of factors, including economic indicators, geopolitical events, and corporate earnings. Over the past five years, the US stock market has demonstrated remarkable resilience, with significant growth in many sectors. However, it has also faced challenges, particularly during periods of economic uncertainty.

Graph Analysis: Key Takeaways

To better understand the US stock market's performance over the past five years, let's analyze a typical 5-year graph. The graph will typically include the following elements:

Market Indexes: The graph will feature major market indexes, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indexes serve as benchmarks for the overall market performance.

Stock Price Movement: The graph will illustrate the stock price movement of individual companies, highlighting their growth or decline over the five-year period.

Market Volatility: The graph will show periods of high volatility, indicating times when the market experienced significant price swings.

Economic Indicators: The graph may also include economic indicators, such as unemployment rates, GDP growth, and inflation, to provide context for market movements.

Sector Performance

Over the past five years, certain sectors have outperformed others. For instance, technology and healthcare stocks have seen substantial growth, driven by factors such as innovation and increased demand for healthcare services. On the other hand, sectors like energy and real estate have faced challenges, particularly during periods of economic uncertainty.

Case Studies

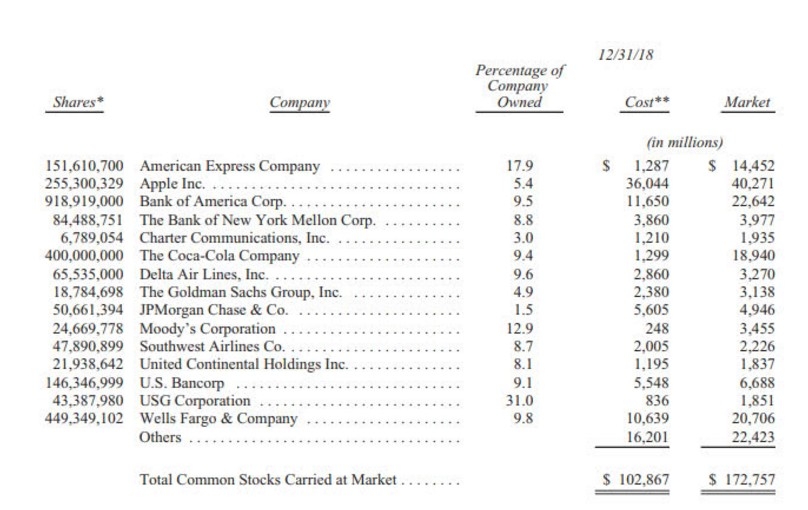

To further illustrate the stock market's performance, let's examine a few case studies:

Tech Giant Apple: Apple Inc. has been a standout performer over the past five years, with its stock price nearly doubling. This growth can be attributed to factors such as strong product launches and increasing market share in key segments.

Biotech Company Moderna: Moderna has experienced a meteoric rise over the past year, primarily due to its COVID-19 vaccine, which has been instrumental in combating the pandemic. However, the stock has experienced significant volatility, reflecting the uncertainty surrounding the market's response to the pandemic.

Energy Sector: The energy sector has faced challenges over the past few years, with falling oil prices and increasing competition from renewable energy sources. Companies like ExxonMobil have seen their stock prices decline, highlighting the sector's struggles.

Conclusion

The US stock market's performance over the past five years has been a mix of growth and volatility, influenced by a variety of factors. By analyzing a 5-year graph, investors and market enthusiasts can gain valuable insights into the market's trajectory and identify potential opportunities for investment. As the market continues to evolve, staying informed and adapting to changing conditions will be key to success.

Title: List of All Stock Symbols in US? us stock market today live cha