In today's volatile global economic landscape, the imposition of tariffs has become a common tool used by governments to protect domestic industries. The United States, being a major player in the global economy, has not been immune to the impacts of tariffs. In this article, we delve into the reaction of US stock futures to tariffs, providing a comprehensive analysis of how these levies have affected the financial markets.

The Tariff Landscape in the US

The United States has imposed tariffs on various goods and services over the years, with the most notable recent example being the tariffs on Chinese goods. These tariffs were implemented in an effort to reduce the trade deficit and protect American industries from what the Trump administration termed as "unfair" trade practices.

Impact on US Stock Futures

The reaction of US stock futures to tariffs has been varied and complex. Initially, when tariffs were first announced, stock futures experienced significant volatility. This can be attributed to the uncertainty surrounding the potential impacts of these tariffs on the economy and businesses.

Case Study: Tariffs and the Tech Sector

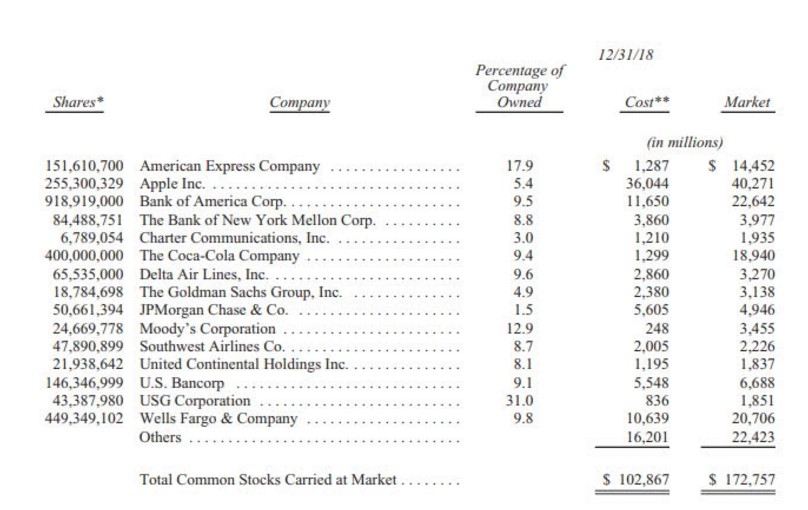

One of the sectors most affected by the tariffs was the technology sector. Companies such as Apple and Google, which rely heavily on Chinese manufacturing, saw their stock prices dip following the imposition of tariffs. This highlights how tariffs can have a direct impact on the profitability and stock prices of companies operating in the global market.

Long-Term Impacts

While the short-term impact of tariffs on stock futures is often negative, the long-term effects can be more nuanced. For instance, in the case of tariffs on Chinese goods, some American companies have started to look for alternative manufacturing locations, leading to increased investments in other countries. This could potentially create new opportunities for growth in these regions.

Inflation and Consumer Spending

Another key factor to consider when analyzing the impact of tariffs on stock futures is inflation. Tariffs can lead to higher prices for goods and services, which in turn can lead to inflation. This can have a negative impact on consumer spending, as consumers may have less disposable income to invest in the stock market.

Conclusion: A Complex Relationship

In conclusion, the reaction of US stock futures to tariffs is a complex and multifaceted issue. While tariffs can lead to short-term volatility, the long-term effects can be more varied and nuanced. Understanding these dynamics is crucial for investors looking to navigate the volatile world of financial markets.

Top 10 Highest Dividend Paying Stocks in th? us stock market today live cha