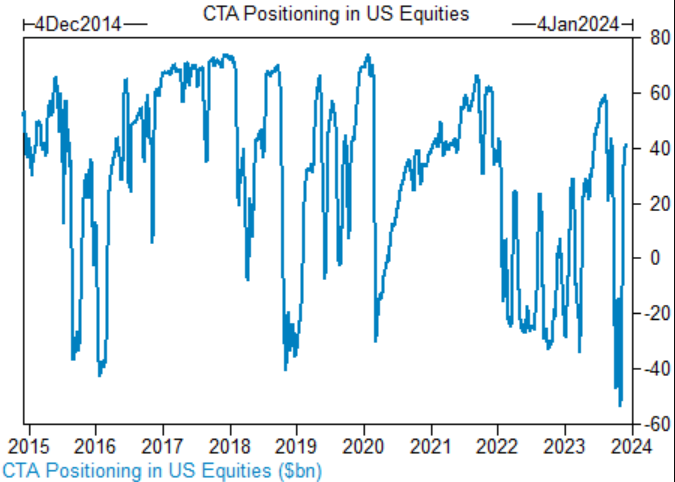

In the wake of recent financial market trends, concerns over the creditworthiness of regional banks have led to a downward trend in the US stock market. This article delves into the factors contributing to this phenomenon, its potential implications, and the strategies investors might adopt to navigate this challenging climate.

Understanding the Issue

The surge in regional bank credit concerns stems from several key factors. These include the rising number of bank failures, increasing interest rates, and a general sense of economic uncertainty. As a result, investors are becoming more cautious, leading to a sell-off in the stock market.

Rising Number of Bank Failures

The past few years have seen an alarming number of bank failures. In March 2023 alone, five banks filed for bankruptcy, a stark contrast to the 16 bank failures recorded in the previous year. This has raised concerns about the overall health of the banking sector and the potential for further bank failures.

Interest Rates and Economic Uncertainty

The Federal Reserve's decision to raise interest rates has had a significant impact on the banking sector. Higher interest rates lead to increased borrowing costs for banks, making it more challenging for them to lend money and generate profits. Additionally, the current economic uncertainty has made investors wary, further exacerbating the downward trend in the stock market.

Impact on the Stock Market

The credit concerns surrounding regional banks have had a ripple effect on the broader stock market. As investors become increasingly cautious, they are selling off their stocks, leading to a downward trend in stock prices. This trend is particularly evident in sectors that are heavily dependent on bank lending, such as real estate and consumer finance.

Strategies for Investors

In light of these challenges, investors need to adopt a cautious approach when navigating the stock market. Here are some strategies that might help:

- Diversification: Diversifying your portfolio can help mitigate the risks associated with regional bank credit concerns. By investing in a variety of sectors and asset classes, you can reduce your exposure to any single stock or sector.

- Research and Due Diligence: It's crucial to conduct thorough research and due diligence before investing in any stock. Look for companies with strong financials, solid management, and a clear growth strategy.

- Stay Informed: Keep up-to-date with the latest financial news and trends. This will help you make informed decisions and stay ahead of the market.

Case Studies

To illustrate the impact of regional bank credit concerns, let's consider the case of Silicon Valley Bank (SVB). In March 2023, SVB faced a liquidity crisis after a massive sell-off in its investment portfolio. The bank's stock plummeted, leading to concerns about its stability and the broader health of the banking sector.

Another example is Signature Bank, which filed for bankruptcy in March 2023. The bank's failure was attributed to a combination of factors, including a lack of liquidity and a significant exposure to the real estate sector.

These case studies highlight the potential risks associated with regional bank credit concerns and the importance of staying informed and cautious when investing in the stock market.

In conclusion, the recent regional bank credit concerns have driven the US stock market down. As investors, it's crucial to understand the factors contributing to this trend and adopt strategies to navigate this challenging climate. By staying informed, conducting thorough research, and diversifying your portfolio, you can mitigate the risks and potentially navigate this challenging environment successfully.

Samsung Electronics Stock in the US Exchang? us stock market today live cha