The US stock industry has long been a cornerstone of the global financial market. As the world's largest stock market, it offers a diverse range of investment opportunities for both domestic and international investors. This article provides a comprehensive overview of the US stock industry, covering its history, major exchanges, key players, and future trends.

History and Evolution

The US stock industry dates back to the early 18th century when the first stock exchange, the New York Stock Exchange (NYSE), was established in 1792. Since then, the industry has undergone significant transformations, with the advent of electronic trading, the rise of online brokers, and the increasing participation of retail investors.

Major Stock Exchanges

The US stock industry is dominated by three major stock exchanges: the New York Stock Exchange (NYSE), the NASDAQ Stock Market, and the Chicago Stock Exchange. The NYSE is the oldest and most prestigious exchange, while the NASDAQ is known for its technology and growth stocks. The Chicago Stock Exchange, on the other hand, is a smaller, regional exchange.

Key Players

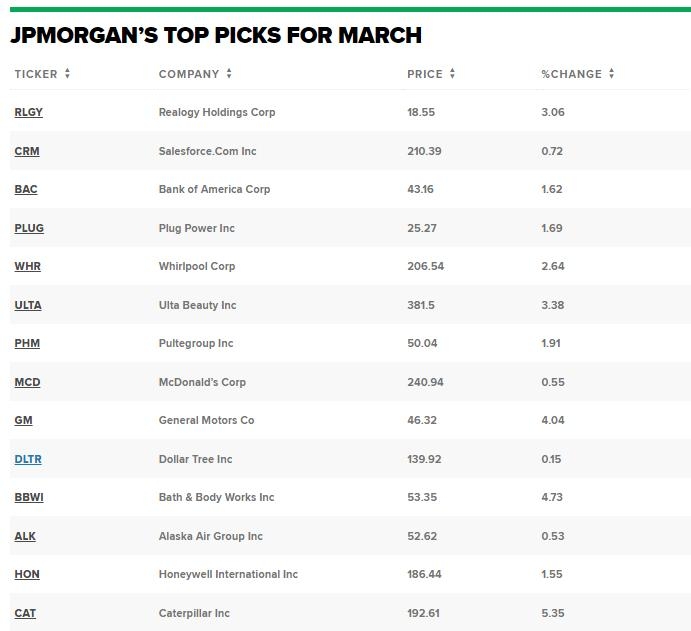

Several key players have shaped the US stock industry over the years. These include investment banks, brokerage firms, and asset management companies. Investment banks, such as Goldman Sachs and JPMorgan Chase, play a crucial role in underwriting IPOs and providing advisory services. Brokerage firms, like Charles Schwab and Fidelity, facilitate trading for individual investors. Asset management companies, such as Vanguard and BlackRock, manage billions of dollars in assets for institutional and retail investors.

Investment Opportunities

The US stock industry offers a wide range of investment opportunities, including stocks, bonds, ETFs, and mutual funds. Investors can choose from a diverse array of sectors, such as technology, healthcare, finance, and consumer goods. The industry also provides access to international stocks through ADRs (American Depositary Receipts).

Regulatory Framework

The US stock industry is regulated by the Securities and Exchange Commission (SEC), which ensures fair and transparent markets. The SEC enforces securities laws, regulates the activities of securities professionals, and protects investors from fraudulent and manipulative practices.

Future Trends

The US stock industry is expected to continue growing, driven by technological advancements, increasing participation of retail investors, and globalization. Some key trends to watch include:

- Robo-advisors: These automated investment platforms are becoming increasingly popular, offering low-cost investment solutions to retail investors.

- Blockchain technology: This decentralized ledger technology has the potential to revolutionize the stock market by improving transparency and reducing fraud.

- ESG investing: Environmental, social, and governance (ESG) investing is gaining traction, as investors increasingly consider the impact of their investments on society and the environment.

Case Study: Tesla, Inc.

One notable company in the US stock industry is Tesla, Inc. (TSLA). Tesla is a leader in the electric vehicle (EV) market and has seen significant growth since its IPO in 2010. The company's innovative technology and strong brand have made it a favorite among investors. However, Tesla has also faced challenges, including production issues and regulatory concerns.

In conclusion, the US stock industry is a dynamic and complex market that offers a wide range of investment opportunities. Understanding its history, major players, and future trends is crucial for investors looking to navigate this ever-evolving landscape.

Analyst Upgrades US Stocks for July 2025: A? us stock market today live cha