The outbreak of the novel coronavirus, Covid-19, has had a profound impact on the global economy, and the US stock market has been no exception. This article delves into the effects of the pandemic on the US stock market, examining the initial shock, recovery efforts, and the long-term implications for investors.

Initial Shock and Market Crash

The first wave of the pandemic in early 2020 led to a rapid and unprecedented decline in the stock market. On March 23, 2020, the S&P 500 index reached its lowest level since 2017, marking the fastest bear market in history. The sudden drop was driven by a combination of factors, including fears of widespread economic shutdowns, falling oil prices, and uncertainty about the virus's spread.

Government Response and Market Recovery

In response to the crisis, the US government implemented several measures to stabilize the economy and support the stock market. The Federal Reserve cut interest rates to near-zero and launched a series of quantitative easing programs to inject liquidity into the financial system. Additionally, Congress passed the CARES Act, which provided financial assistance to individuals and businesses affected by the pandemic.

These measures helped to stabilize the stock market and initiate a recovery. By the end of 2020, the S&P 500 had recovered most of its losses, and the market continued to climb throughout 2021.

Sector-Specific Impacts

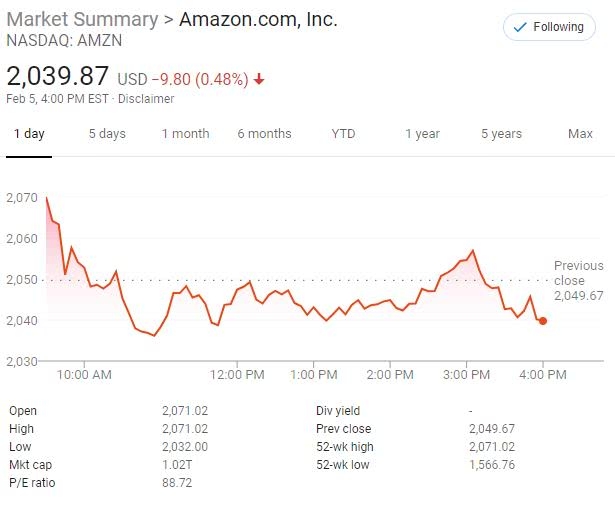

The pandemic has had a varied impact on different sectors of the US stock market. Technology stocks, which have been a major driver of the market's growth, have generally performed well during the crisis. Companies like Apple, Amazon, and Microsoft have seen their shares soar as remote work and online shopping became more prevalent.

In contrast, energy and travel stocks have been hit hard by the pandemic. Oil prices plummeted in early 2020, and airlines have faced significant financial challenges as travel restrictions were imposed. However, some sectors, such as healthcare and biotechnology, have seen significant growth as companies work to develop treatments and vaccines for the virus.

Long-Term Implications

The long-term implications of the pandemic on the US stock market are still unfolding. Some investors believe that the market will continue to grow as the economy recovers, while others are concerned about the potential for future volatility and market corrections.

One key factor to watch is the pace of vaccination efforts, as a widespread distribution of vaccines could lead to a more rapid economic recovery and a further boost to the stock market. Another factor is the potential for long-term changes in consumer behavior, such as an increased reliance on remote work and online shopping.

Case Study: Tesla

A notable example of how the pandemic has affected the stock market is the rise of Tesla, Inc.. Despite the overall market downturn, Tesla's stock has surged since the start of the pandemic, driven by strong demand for electric vehicles and the company's expansion into new markets.

Conclusion

The impact of Covid-19 on the US stock market has been significant, with a rapid decline followed by a recovery. As the pandemic continues to evolve, investors will need to stay informed and adapt to the changing landscape. By understanding the sector-specific impacts and long-term implications, investors can make more informed decisions and navigate the challenges ahead.

US Large Cap Stocks Momentum Indicators: Ju? us stock market today