The US Stock Market 100 has long been a beacon for investors seeking growth and stability. This article delves into a comprehensive five-year analysis of the US Stock Market 100, providing valuable insights into its performance, trends, and future prospects.

Understanding the US Stock Market 100

The US Stock Market 100 refers to a group of 100 highly capitalized and influential companies listed on major US stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. These companies represent a broad range of sectors, including technology, healthcare, finance, and consumer goods.

Performance Over the Past Five Years

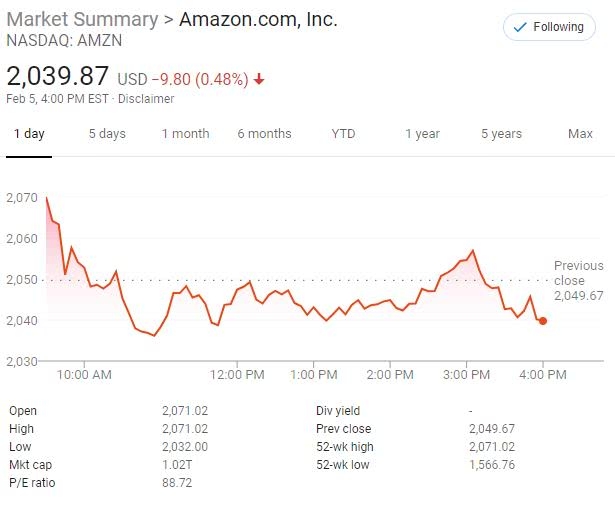

Over the past five years, the US Stock Market 100 has exhibited remarkable performance, with significant growth across various sectors. Technology has been the standout performer, driven by giants like Apple, Microsoft, and Amazon. These companies have leveraged the digital revolution to expand their market share and generate substantial returns for investors.

Sector Analysis

- Technology: The technology sector has seen exponential growth over the past five years, with companies like Apple and Microsoft experiencing remarkable stock price appreciation. This growth can be attributed to their strong market position, innovation, and adaptability to changing market dynamics.

- Healthcare: The healthcare sector has also performed well, with pharmaceutical companies and biotech firms leading the charge. Companies like Johnson & Johnson and Pfizer have showcased robust growth, driven by increased demand for healthcare products and services.

- Finance: The finance sector has experienced steady growth, with financial institutions like JPMorgan Chase and Goldman Sachs benefiting from improved economic conditions and regulatory changes.

Trends and Future Prospects

The US Stock Market 100 is expected to continue its upward trend in the coming years, driven by various factors:

- Economic Growth: The US economy has been recovering from the COVID-19 pandemic, with signs of sustained economic growth. This recovery is expected to benefit the US Stock Market 100, as companies across various sectors gain from increased consumer spending and business investments.

- Innovation: The pace of innovation remains a key driver of growth for the US Stock Market 100. Companies like Google and Tesla continue to push the boundaries of technology and consumer goods, creating new opportunities for investors.

- Regulatory Changes: The regulatory landscape is also a critical factor in shaping the future of the US Stock Market 100. The introduction of new regulations, such as those concerning data privacy and antitrust, can have a significant impact on company performance and market dynamics.

Case Studies

To provide a clearer picture of the performance of the US Stock Market 100, let's look at a few case studies:

- Apple: Over the past five years, Apple has seen its stock price appreciate by over 50%. This growth can be attributed to its strong product pipeline, global market presence, and commitment to innovation.

- Microsoft: Microsoft has also performed well, with its stock price increasing by over 30% over the same period. The company's diversification into cloud computing and gaming has been a significant factor in its success.

- Johnson & Johnson: Johnson & Johnson has seen steady growth, with its stock price increasing by over 20% over the past five years. The company's focus on healthcare innovation and its robust product portfolio have been key drivers of this growth.

In conclusion, the US Stock Market 100 has showcased remarkable performance over the past five years, driven by strong economic conditions, innovation, and sector diversification. As the economy continues to recover and new opportunities arise, the US Stock Market 100 is expected to remain a compelling investment destination for investors seeking growth and stability.

Unicredit US Stock: A Comprehensive Guide t? us stock market today