Understanding the Possibility and Process

Are you considering expanding your investment portfolio beyond the UK? If so, you might be wondering, "Can the UK buy US stocks?" The answer is a resounding yes. Investing in US stocks from the UK is not only possible but also a viable and potentially lucrative option for investors. This article will explore the process, benefits, and potential risks of purchasing US stocks from the UK.

The Basics of Investing in US Stocks from the UK

To start, it's essential to understand that when you purchase US stocks from the UK, you're essentially buying shares of a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. The process is straightforward:

Open a Brokerage Account: The first step is to open a brokerage account with a UK-based or international broker that offers access to US stocks. This account will serve as your platform for buying and selling stocks.

Convert Currency: Since the UK and the US use different currencies (GBP and USD, respectively), you'll need to convert your GBP into USD to make a purchase. Many brokers offer currency conversion services, which may come with additional fees.

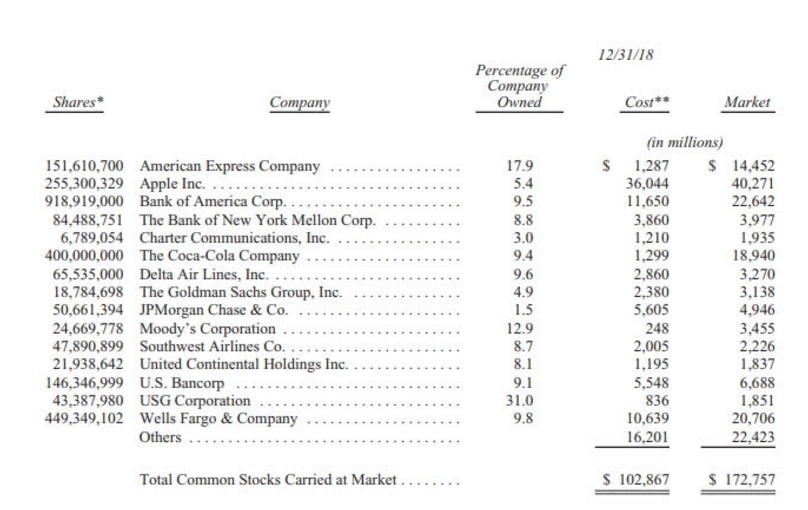

Research and Select Stocks: Once you have your brokerage account and currency converted, it's time to research potential stocks. This can involve looking at company fundamentals, financial statements, market trends, and other factors.

Place Your Order: Once you've chosen a stock, you can place a buy order through your brokerage platform. The order can be executed immediately or as a limit order, which will execute only at the specified price.

Benefits of Investing in US Stocks from the UK

Several benefits make investing in US stocks from the UK an attractive option:

- Diversification: The US stock market is one of the largest and most diversified in the world, offering exposure to a wide range of industries and sectors.

- Potential for Growth: The US has a strong track record of economic growth, which can translate to higher returns on your investments.

- Access to Innovative Companies: The US is home to many of the world's most innovative companies, such as Apple, Google, and Amazon.

Potential Risks

While investing in US stocks from the UK has many benefits, it's essential to be aware of potential risks:

- Currency Fluctuations: Exchange rate movements can impact the value of your investments. A strengthening USD could result in lower returns when converted back to GBP.

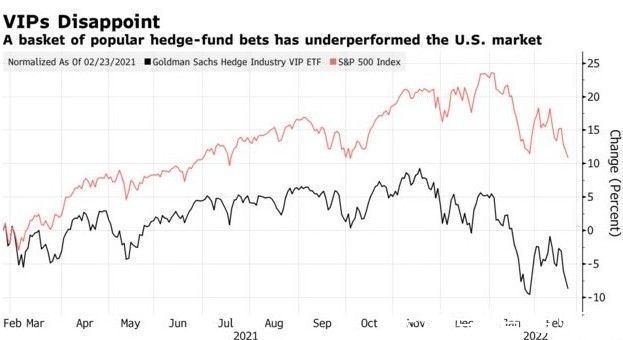

- Market Volatility: The US stock market can be highly volatile, especially during economic downturns or geopolitical events.

- Regulatory Differences: There are differences in financial regulations between the UK and the US, which can affect your investments.

Case Study: Investing in US Stocks through a UK Broker

Let's say you're interested in investing in Apple (AAPL) from the UK. You open a brokerage account with a UK-based broker that offers access to US stocks. You convert your GBP into USD, conduct thorough research on Apple, and place a buy order for 10 shares at

Several months later, Apple's share price increases to $200 per share. You decide to sell your shares, converting your USD back to GBP. After fees and exchange rate fluctuations, you make a profit of approximately £400 on your investment.

Conclusion

Investing in US stocks from the UK is a feasible and potentially profitable option for investors. While there are risks involved, the benefits of diversification and access to innovative companies make it an attractive opportunity. By understanding the process and conducting thorough research, you can make informed investment decisions and potentially grow your portfolio.

Samsung Electronics Stock in the US Exchang? us stock market today