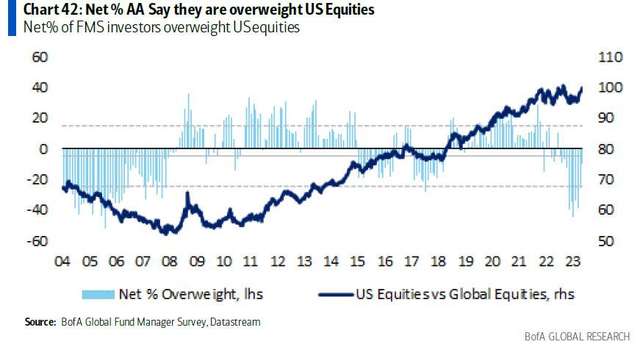

The US stock market has been a beacon of strength for investors worldwide, but recent trends have raised red flags about potential overvaluation. This article delves into the signs of overvaluation and examines the potential consequences for investors who fail to heed the warnings.

Understanding Overvaluation

Overvaluation refers to a situation where the price of stocks is higher than their intrinsic value. This discrepancy can occur due to a variety of factors, including excessive optimism, market manipulation, or economic imbalances. Historically, overvalued markets have often experienced significant corrections, leading to substantial losses for investors.

Signs of Overvaluation

Several indicators suggest that the US stock market may be overvalued at present:

- High Price-to-Earnings (P/E) Ratios: The P/E ratio measures the price of a stock relative to its earnings. Historically, a P/E ratio above 20 has been considered overvalued. Currently, the S&P 500 index has a P/E ratio of around 27, indicating potential overvaluation.

- Overvalued Valuations: The Shiller P/E ratio, also known as the cyclically adjusted P/E ratio, smooths out short-term fluctuations in earnings. The current Shiller P/E ratio for the S&P 500 is around 32, significantly higher than its long-term average of around 16.

- High Stock Market Valuations: The Q-ratio, which compares the market value of stocks to their replacement cost, has been above its historical average for several years. This suggests that the stock market may be overvalued.

- Excessive Margin Debt: Margin debt, which represents the amount of money borrowed by investors to purchase stocks, has reached record levels. This can indicate excessive optimism and a potential bubble.

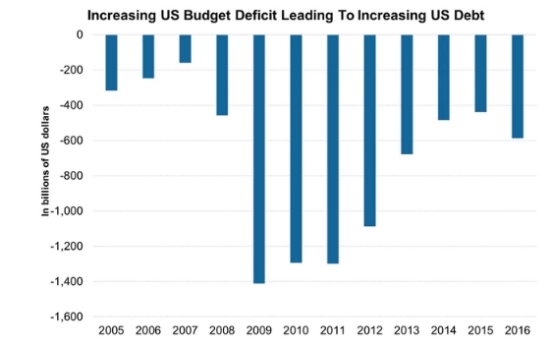

- Economic Indicators: Some economic indicators, such as the yield curve and inflation, suggest that the US economy may be approaching a downturn, which could lead to a correction in the stock market.

Consequences of Overvaluation

Investors who ignore the signs of overvaluation may face significant losses if the market corrects. Some potential consequences include:

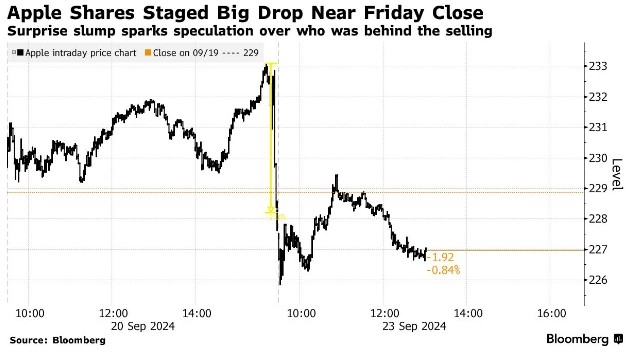

- Stock Market Correction: The stock market may experience a significant downturn, leading to substantial losses for investors.

- Increased Volatility: The stock market may become more volatile, with frequent ups and downs in stock prices.

- Economic Slowdown: An overvalued stock market can lead to an economic slowdown, as businesses may struggle to raise capital and invest in growth.

- Debt Crisis: Excessive margin debt can lead to a debt crisis, as investors may be unable to repay their loans.

Case Studies

Several historical examples illustrate the consequences of overvaluation:

- Dot-Com Bubble: In the late 1990s, the dot-com bubble led to an overvaluation of technology stocks. When the bubble burst, the NASDAQ index lost more than 75% of its value, leading to significant losses for investors.

- 2008 Financial Crisis: The 2008 financial crisis was triggered by an overvaluation of mortgage-backed securities. The crisis led to a global recession and a significant downturn in the stock market.

Conclusion

The US stock market may be overvalued at present, raising concerns about potential risks for investors. It is crucial for investors to be aware of the signs of overvaluation and to take appropriate measures to protect their investments. By understanding the potential consequences of overvaluation and taking proactive steps, investors can navigate the market's ups and downs more effectively.

Can You Invest in US Stocks in the UK?? us stock market live