Introduction: The China-US stock exchange relationship has been a significant factor in the global financial market. As the world's two largest economies, the United States and China have a strong influence on each other's stock markets. This article aims to provide a comprehensive guide to the China-US stock exchange, covering key aspects such as market structure, trading mechanisms, and investment opportunities.

Market Structure

The China-US stock exchange relationship is characterized by a dual-listing system. This means that companies can list their shares on both the Shanghai and New York Stock Exchanges (NYSE), allowing investors from both countries to trade in each other's markets. The Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE) are the two main stock exchanges in China, while the NYSE and the NASDAQ are the major exchanges in the United States.

Trading Mechanisms

Trading mechanisms in the China-US stock exchange vary in some aspects. In China, trading is conducted in sessions, with the morning session from 9:30 am to 11:30 am and the afternoon session from 1:00 pm to 3:00 pm. The trading system is based on a limit order-driven market, where investors can place buy or sell orders with specified prices and quantities.

In the United States, trading is conducted continuously, and investors can place market orders, limit orders, and stop orders. The trading system is based on an auction market, where the price is determined by the supply and demand of the shares.

Investment Opportunities

Investing in the China-US stock exchange offers numerous opportunities for investors. Here are some key areas:

Technology and Consumer Goods: The technology and consumer goods sectors are among the most attractive in the China-US stock exchange. Companies like Alibaba, Tencent, and Baidu are listed on the NYSE and NASDAQ, while Chinese tech giants like Huawei and Xiaomi are listed on the SSE and SZSE.

Healthcare: The healthcare sector has seen significant growth in both the United States and China. Companies like Johnson & Johnson and Pfizer are listed on the NYSE, while Chinese pharmaceutical companies like Sino Biopharm and China Resources Land are listed on the SSE and SZSE.

Energy and Resources: The energy and resources sector is another area with investment potential. Companies like ExxonMobil and Chevron are listed on the NYSE, while Chinese energy companies like PetroChina and Sinopec are listed on the SSE and SZSE.

Case Studies

To illustrate the investment opportunities in the China-US stock exchange, let's consider a few case studies:

Alibaba: Founded in 1999, Alibaba is one of the largest e-commerce companies in the world. It was listed on the NYSE in 2014 and has since become a major investment destination for U.S. investors.

Tencent: As a leading Chinese technology company, Tencent was listed on the Hong Kong Stock Exchange in 2004. It has since expanded its operations to the United States, making it an attractive investment opportunity for U.S. investors.

PetroChina: As the largest oil and gas company in China, PetroChina was listed on the NYSE in 2000. It has provided significant returns for investors and is a key player in the energy and resources sector.

Conclusion:

The China-US stock exchange relationship is a vital part of the global financial market. With a diverse range of investment opportunities, investors can benefit from the growth of both the Chinese and U.S. economies. Understanding the market structure, trading mechanisms, and key sectors can help investors make informed decisions and capitalize on the China-US stock exchange.

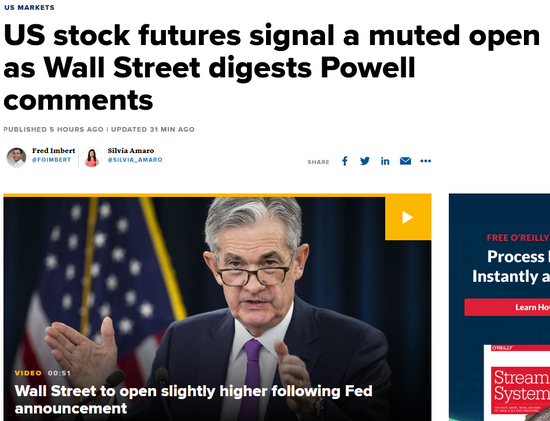

Is the US Stock Market Open? Understanding ? us stock market live