The potential outbreak of war between the United States and Iran has sent shockwaves through the global stock market. Investors are on edge, and the implications for the stock market are significant. This article delves into the potential impact of a US-Iran war on the stock market, providing insights and analysis for investors.

Understanding the Situation

The tensions between the United States and Iran have been escalating for years. The recent assassination of Qassem Soleimani, the head of Iran's Quds Force, by the U.S., has heightened the tensions to an unprecedented level. The situation is volatile, and the potential for a full-blown conflict is a genuine concern.

Impact on Oil Prices

One of the most immediate and significant impacts of a US-Iran war would be on oil prices. Iran is one of the world's largest oil producers, and any disruption in its oil exports could lead to a significant rise in global oil prices. This would have a ripple effect on the stock market, as energy companies and other sectors that rely on oil prices would be affected.

Sector-Specific Impacts

Energy Sector: As mentioned earlier, the energy sector would be one of the most affected. Oil prices would likely soar, leading to increased profits for energy companies. However, the volatility in the market could also lead to significant losses.

Technology Sector: The technology sector, on the other hand, might not be directly affected by the conflict. However, if the situation leads to a global economic downturn, the technology sector could be hit hard, as businesses cut back on spending.

Financial Sector: The financial sector could also be affected. If the conflict leads to a global economic downturn, banks and financial institutions could face increased defaults and credit risk.

Case Study: The 2003 Iraq War

To understand the potential impact of a US-Iran war on the stock market, it's helpful to look at historical precedents. The 2003 Iraq war serves as a relevant case study. Following the invasion of Iraq, the stock market experienced significant volatility. Energy stocks surged as oil prices soared, while other sectors, such as technology and financials, were hit hard.

Investment Strategies

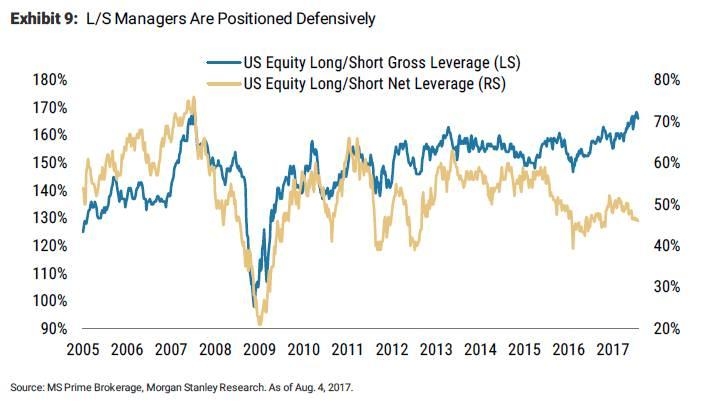

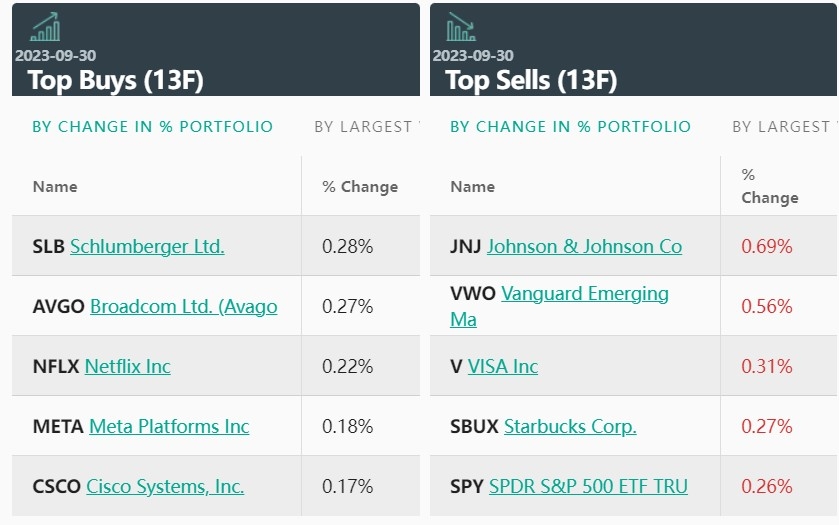

Given the potential volatility in the stock market due to the US-Iran conflict, investors should consider adopting a diversified investment strategy. Diversification can help mitigate the risks associated with any single sector or asset class.

Conclusion

The potential outbreak of war between the United States and Iran poses significant risks to the global stock market. Investors should stay informed and consider adopting a diversified investment strategy to mitigate the risks associated with the conflict. As always, it's crucial to consult with a financial advisor before making any investment decisions.

Indian Stocks vs. US Stocks: A Comprehensiv? us stock market live