In the world of global investments, the stock markets of India and the United States have been attracting the attention of investors for years. Both markets offer unique opportunities and challenges, making it essential for investors to understand the differences between Indian stocks and US stocks. This article aims to provide a comprehensive comparison of these two markets, highlighting their key characteristics and factors to consider before making investment decisions.

Market Size and Growth

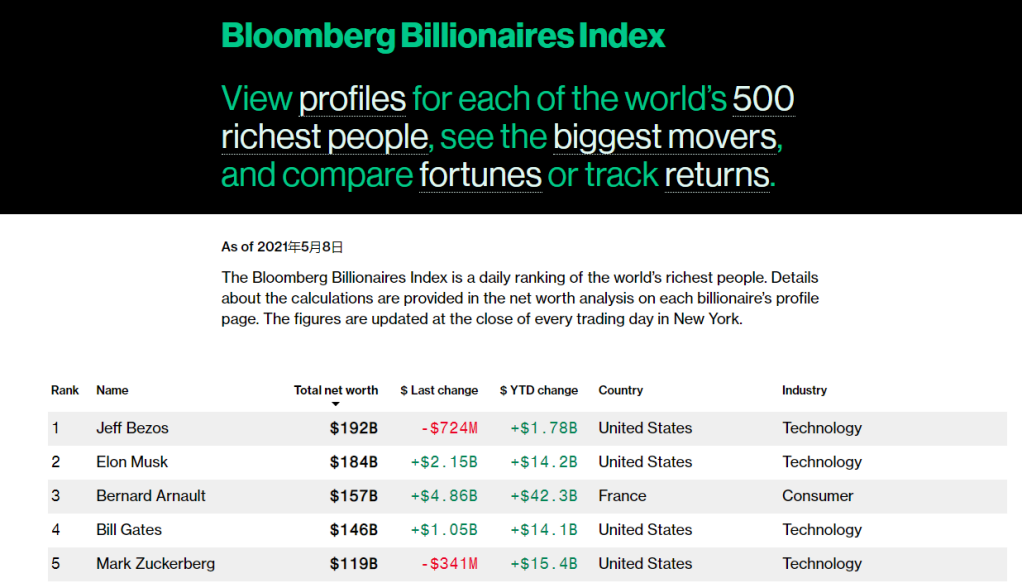

One of the most significant differences between Indian stocks and US stocks is their market size and growth potential. The US stock market is the largest in the world, with a market capitalization of over $30 trillion. It is home to many of the world's largest and most influential companies, including tech giants like Apple, Microsoft, and Google.

In contrast, the Indian stock market is much smaller, with a market capitalization of around $2 trillion. However, it has been growing rapidly, with a compound annual growth rate (CAGR) of around 10% over the past decade. This growth is driven by a young and growing population, increasing consumer spending, and the government's focus on infrastructure development.

Industry Composition

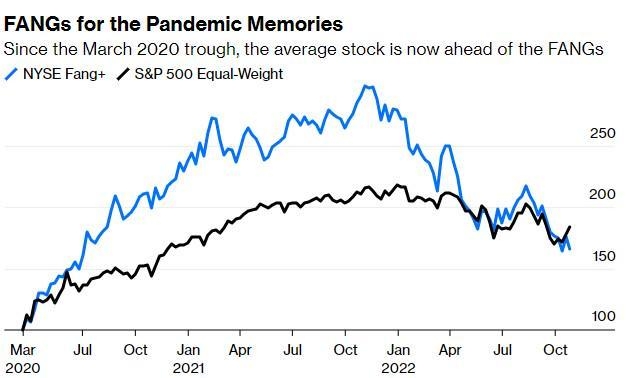

The industry composition of the two markets also differs significantly. The US stock market is dominated by technology, healthcare, and consumer discretionary sectors. These sectors have been driving the market's growth, with companies like Amazon, Facebook, and Johnson & Johnson leading the way.

On the other hand, the Indian stock market is more diversified, with significant exposure to sectors such as banking, finance, and IT. Companies like HDFC Bank, TCS, and Infosys have been key contributors to the market's growth.

Market Regulation

The regulatory framework in the US and India also differs. The US has a well-established and stringent regulatory framework, with the Securities and Exchange Commission (SEC) overseeing the market. This has led to a high level of transparency and investor protection.

In India, the Securities and Exchange Board of India (SEBI) is responsible for regulating the market. While SEBI has been making efforts to improve transparency and investor protection, there are still some concerns regarding the effectiveness of the regulatory framework.

Currency Risk

Investors in Indian stocks face currency risk, as the Indian rupee is a volatile currency. Fluctuations in the exchange rate can significantly impact the returns on investments. In contrast, investors in US stocks do not face this risk, as the returns are in US dollars.

Dividends and Yield

Dividends and yield are also important factors to consider when comparing Indian stocks and US stocks. The US stock market generally offers higher dividends and yields compared to the Indian market. This is due to the higher profitability of US companies and the more mature dividend culture in the US.

Conclusion

In conclusion, Indian stocks and US stocks offer unique opportunities and challenges for investors. While the US stock market is larger and more established, the Indian market offers higher growth potential and exposure to different sectors. Investors should carefully consider their investment objectives, risk tolerance, and market conditions before deciding where to invest. By understanding the key differences between these two markets, investors can make informed decisions and maximize their returns.

Is the US Stock Market Open? Understanding ? new york stock exchange