Dividend stocks have long been a popular investment choice for investors seeking regular income and long-term capital growth. However, understanding the intricacies of dividend taxation, particularly the withholding tax on US dividend stocks, is crucial for making informed investment decisions. In this article, we delve into the details of US dividend stocks withholding tax, its implications, and how it affects your investment returns.

What is US Dividend Stocks Withholding Tax?

The US dividend stocks withholding tax refers to the percentage of dividends that the IRS (Internal Revenue Service) requires the payer of dividends (typically a corporation) to withhold on behalf of non-resident aliens or foreign investors. This tax is designed to ensure that foreign investors pay taxes on the dividends they receive from US companies.

Tax Rates and Implications

The rate of the US dividend stocks withholding tax can vary depending on the investor's country of residence. Generally, for foreign investors, the tax rate is 30%. However, many countries have tax treaties with the United States that reduce this rate to 15% or even lower.

How Does the Withholding Tax Affect Your Investment Returns?

The withholding tax on US dividend stocks can significantly impact your investment returns, particularly if you are a foreign investor. Here’s how:

Reduced Dividend Income: The withheld tax amount is deducted from the total dividend payment you receive. This means you'll receive a smaller dividend income than you would have if there was no withholding tax.

Tax Liabilities: Depending on your country of residence, you may need to pay additional taxes on the dividends received from US stocks. This can result in double taxation, where you are taxed twice—once by the US and once by your home country.

Impact on Investment Strategy: The potential for double taxation may discourage some foreign investors from investing in US dividend stocks, which can affect the demand and, consequently, the price of these stocks.

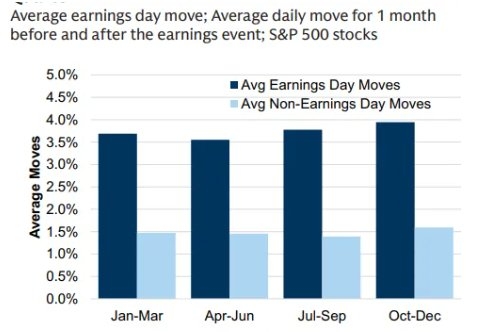

Case Study: Dividend Stocks in the S&P 500

Let's consider a hypothetical scenario involving a foreign investor who purchases shares of a company listed in the S&P 500. The company pays a dividend of $1 per share, and the withholding tax rate is 30%.

- Dividend Received: The investor receives a dividend of $1 per share.

- Withheld Tax: The US corporation withholds

0.30 (30% of 1) as tax. - Net Dividend: The investor receives

0.70 ( 1 - $0.30) as a net dividend.

This scenario highlights the impact of the US dividend stocks withholding tax on foreign investors' dividend income.

Conclusion

Understanding the US dividend stocks withholding tax is essential for foreign investors considering investments in US companies. While the tax rate can be a significant factor in investment returns, it's crucial to weigh it against the potential benefits of investing in high-quality, dividend-paying US stocks. Always consult with a financial advisor or tax professional to ensure compliance with tax regulations and to optimize your investment strategy.

How Can a Foreigner Invest in US Stocks?? us steel stock dividend