Introduction

Investing in US stocks can be an exciting opportunity for foreign investors looking to diversify their portfolios and capitalize on the world's largest and most dynamic economy. However, navigating the complexities of the US stock market can be challenging for those unfamiliar with its regulations and processes. In this article, we'll explore the steps and considerations for foreign investors interested in investing in US stocks.

Understanding the Basics

Before diving into the specifics of investing in US stocks, it's crucial to understand the basics. The US stock market is primarily composed of two major exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list a wide range of companies, from small startups to multinational corporations.

Steps to Invest in US Stocks

Open a Brokerage Account: The first step is to open a brokerage account with a reputable brokerage firm. Many brokerage firms offer accounts specifically tailored to international investors. Be sure to compare fees, available investment options, and customer service before choosing a broker.

Understand the Regulations: As a foreign investor, you'll need to comply with certain regulations, such as the Foreign Account Tax Compliance Act (FATCA). Familiarize yourself with these regulations to ensure compliance and avoid potential penalties.

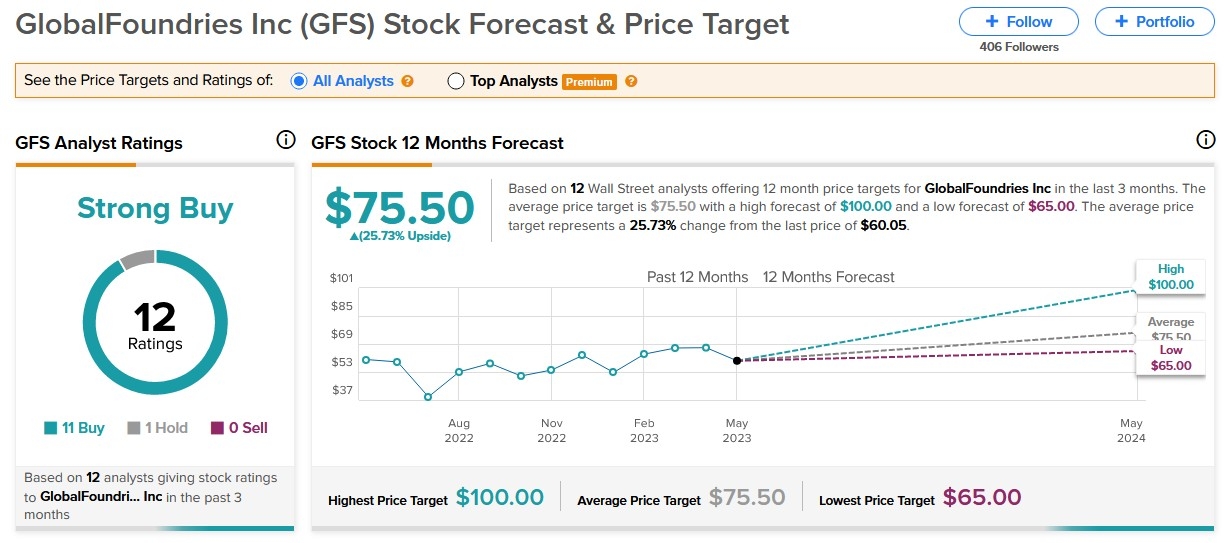

Choose Your Investments: Once you have your brokerage account, you can start researching and selecting stocks to invest in. Consider factors such as the company's financial health, industry trends, and your investment goals.

Research and Analyze: Conduct thorough research on the companies you're interested in. Utilize financial ratios, news articles, and other resources to gain insights into the company's performance and potential.

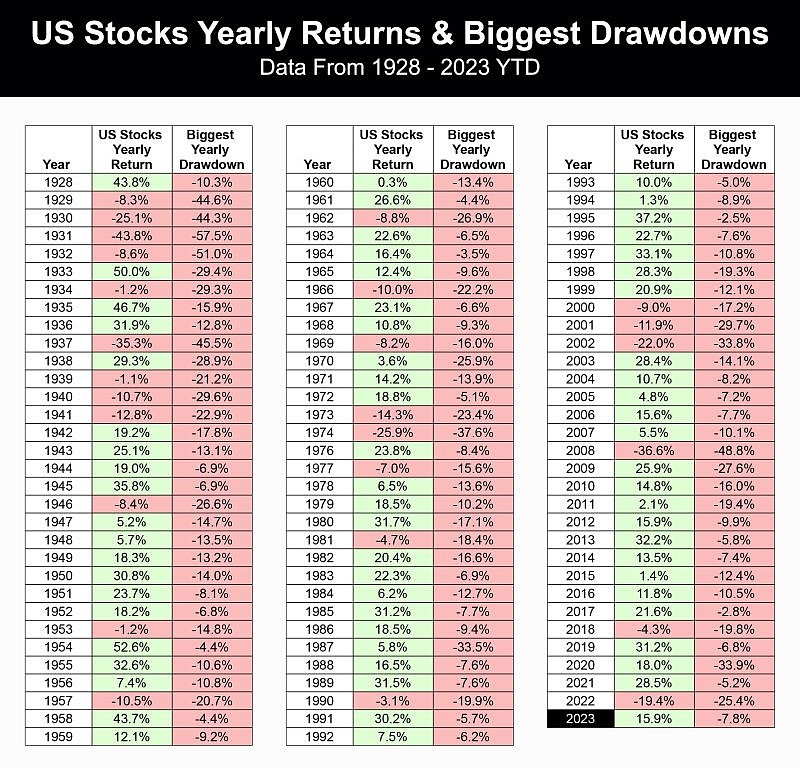

Diversify Your Portfolio: Diversification is key to mitigating risk. Consider investing in a mix of stocks across different industries and geographic regions.

Monitor Your Investments: Regularly review your investments to ensure they align with your investment strategy. Don't hesitate to adjust your portfolio as needed.

Case Study: Investing in Apple (AAPL)

Consider the case of a foreign investor interested in investing in Apple (AAPL), one of the most popular and successful companies in the world. The investor should:

- Research Apple's financial health, including its revenue, profit margins, and debt levels.

- Analyze Apple's competitive position in the technology industry and its growth prospects.

- Compare Apple's stock price with its intrinsic value to determine if it's a good investment opportunity.

- Monitor Apple's performance and adjust the investment as needed.

Considerations for Foreign Investors

- Currency Conversion: Be aware of currency conversion fees and exchange rate fluctuations when investing in US stocks.

- Tax Implications: Understand the tax implications of investing in US stocks as a foreign investor. Consult with a tax professional to ensure compliance with your country's tax laws.

- Language and Cultural Barriers: Be prepared for potential language and cultural barriers when researching and analyzing US stocks.

Conclusion

Investing in US stocks can be a rewarding experience for foreign investors. By understanding the basics, following the steps outlined in this article, and considering the unique challenges faced by foreign investors, you can make informed investment decisions and potentially grow your wealth.

Best US Stocks to Invest In 2024: A Strateg? new york stock exchange