Are you considering investing in US stocks but feeling overwhelmed by the process? Don't worry; you're not alone. Investing in stocks can be a daunting task, especially for beginners. However, with the right information and guidance, you can start building your portfolio and potentially reap the benefits of the US stock market. In this article, we'll explore the steps you need to take to invest in US stocks, including opening a brokerage account, researching companies, and understanding the risks involved.

Opening a Brokerage Account

The first step in investing in US stocks is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. There are several types of brokerage accounts to choose from, including:

- Online Brokerage Accounts: These accounts are typically the most cost-effective and offer a wide range of investment options. Many online brokers offer free or low-cost trading fees, making them an excellent choice for beginners.

- Full-Service Brokerage Accounts: These accounts offer personalized advice and support from a financial advisor. While they can be more expensive, they may be worth the cost if you're looking for expert guidance.

- Robo-Advisors: These are automated investment platforms that use algorithms to manage your portfolio. They are a good option if you prefer a hands-off approach to investing.

When choosing a brokerage account, consider factors such as fees, investment options, and customer service. Some popular online brokers include TD Ameritrade, E*TRADE, and Charles Schwab.

Researching Companies

Once you have a brokerage account, the next step is to research companies. This involves analyzing their financial statements, reading their annual reports, and researching their industry and competitors. Here are some key factors to consider when researching a company:

- Financial Health: Look at the company's income statement, balance sheet, and cash flow statement to assess its financial health. Pay attention to metrics such as revenue growth, profit margins, and debt levels.

- Industry and Competitors: Research the company's industry and its competitors. Look for companies with strong market positions and growth potential.

- Management: Assess the company's management team and their track record. Look for experienced and competent leaders with a clear vision for the company's future.

Understanding Risks

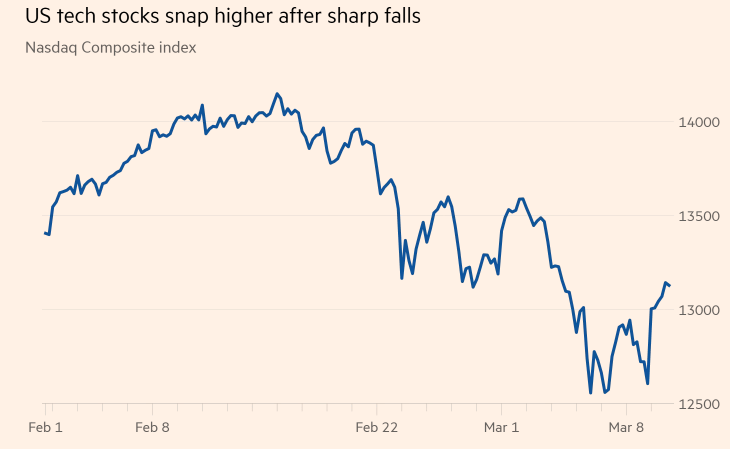

Investing in stocks always comes with risks, including the potential for loss of capital. It's important to understand the risks involved before investing. Here are some common risks:

- Market Risk: The stock market can be volatile, and the value of your investments can fluctuate significantly.

- Company Risk: The performance of a company can be affected by various factors, including economic conditions, competition, and management decisions.

- Liquidity Risk: Some stocks may be less liquid, meaning it may be difficult to sell them quickly without impacting the price.

Case Study: Apple Inc.

To illustrate the process of investing in US stocks, let's take a look at Apple Inc. (AAPL). Apple is a global technology company known for its innovative products, including the iPhone, iPad, and Mac computers.

When researching Apple, you might look at its financial statements and find that it has a strong revenue growth rate and a high profit margin. You might also research the company's industry and find that it is a leader in the technology sector.

Before investing in Apple, it's important to understand the risks involved. The stock market can be volatile, and the value of your investment could fluctuate significantly.

Conclusion

Investing in US stocks can be a rewarding experience, but it requires research, patience, and discipline. By following these steps and understanding the risks involved, you can start building your portfolio and potentially achieve your financial goals. Remember to consult with a financial advisor if you need personalized advice.

Stocks with Momentum: Short-Term Opportunit? new york stock exchange