In the vast and dynamic world of investing, US large value company stocks have emerged as a cornerstone for many investors seeking long-term growth and stability. These stocks represent shares in some of the largest and most established companies in the United States, offering a unique blend of market dominance and potential for significant returns. In this article, we delve into the intricacies of investing in US large value company stocks, exploring their benefits, risks, and the strategies that can maximize your investment potential.

Understanding Large Value Company Stocks

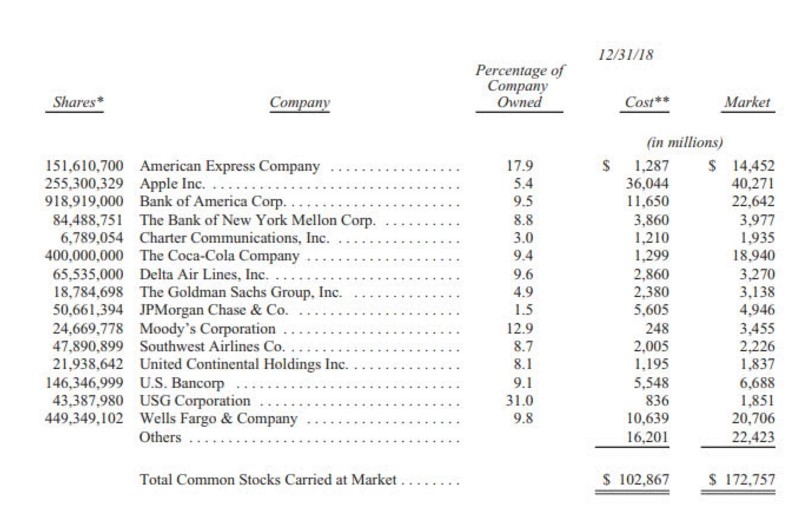

Large value company stocks, often referred to as "large caps," are shares in companies with a market capitalization of $10 billion or more. These companies typically operate in well-established industries and have a proven track record of profitability and growth. Notable examples include tech giants like Apple and Microsoft, as well as household names like Johnson & Johnson and Procter & Gamble.

The Advantages of Investing in Large Value Stocks

- Stability and Reliability: Large value companies often have a strong presence in their respective markets, making them more resilient to economic downturns and market fluctuations.

- Dividends: Many large value companies pay regular dividends, providing investors with a steady stream of income.

- Dividend Growth: These companies often have a history of increasing dividends over time, enhancing shareholder value.

- Market Influence: Large value companies can have a significant impact on market trends and can influence broader economic indicators.

The Risks Involved

While investing in large value company stocks offers numerous benefits, it's essential to be aware of the risks:

- Market Risk: Large value companies, like all stocks, are subject to market volatility and can experience significant price fluctuations.

- Economic Risk: Economic downturns can impact the profitability of large value companies, potentially leading to lower stock prices.

- Interest Rate Risk: Large value companies with significant debt may be more sensitive to changes in interest rates.

Strategies for Success

To maximize your investment in US large value company stocks, consider the following strategies:

- Diversification: Invest in a variety of large value stocks across different industries to spread out your risk.

- Research and Analysis: Conduct thorough research on potential investments to ensure they align with your investment goals and risk tolerance.

- Long-term Perspective: Large value companies often require a long-term perspective to realize their full potential.

Case Study: Apple Inc.

A prime example of a successful investment in a large value company is Apple Inc. Since its initial public offering in 1980, Apple has grown to become one of the largest and most valuable companies in the world. Its shares have provided investors with substantial returns over the years, driven by its innovative products and strong market presence.

In conclusion, US large value company stocks offer a compelling investment opportunity for those seeking stability, dividends, and potential long-term growth. By understanding the risks and employing strategic investment approaches, investors can unlock the full potential of these stocks.

Toys R Us Stock Trends Chart 2017: A Compre? us steel stock dividend