Understanding the Importance of US Stock Exchange Indices

In the world of finance, the US stock exchange indices play a pivotal role in reflecting the market's health and performance. These indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, serve as barometers for investors to gauge the overall direction of the market. This article aims to provide a comprehensive guide to the US stock exchange indices, their significance, and how they impact investment decisions.

The S&P 500: A Benchmark for Large-Cap Stocks

The S&P 500, or Standard & Poor's 500, is one of the most widely followed stock market indices in the United States. It tracks the performance of 500 large-cap companies across various sectors, including technology, healthcare, and finance. The S&P 500 is often considered a benchmark for the broader market and is widely used by investors to gauge the overall health of the US economy.

The Dow Jones Industrial Average: A Historical Perspective

The Dow Jones Industrial Average, or simply the Dow, is one of the oldest and most well-known stock market indices. It tracks the performance of 30 large, publicly-owned companies across various sectors, including transportation, energy, and technology. The Dow has been a significant indicator of the US stock market's performance since its inception in 1896.

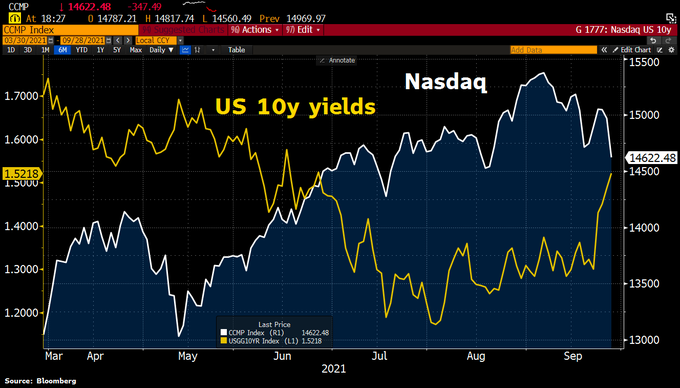

The NASDAQ Composite: A Leader in Technology Stocks

The NASDAQ Composite is a broad-based index that tracks the performance of all domestic and international common stocks listed on the NASDAQ stock exchange. It is particularly known for its heavy concentration of technology stocks, including giants like Apple, Microsoft, and Amazon. The NASDAQ Composite is often considered a bellwether for the technology sector and the broader market.

Impact of US Stock Exchange Indices on Investment Decisions

Understanding the US stock exchange indices is crucial for investors to make informed decisions. These indices provide a snapshot of the market's performance, allowing investors to identify trends and potential opportunities. For instance, a rising S&P 500 could indicate a strong market, while a falling Dow might suggest a bearish trend.

Case Study: The 2008 Financial Crisis

One notable example of how US stock exchange indices can impact the market is the 2008 financial crisis. The S&P 500 and the Dow Jones Industrial Average plummeted during this period, reflecting the widespread panic and uncertainty in the market. Investors who were able to recognize this trend and adjust their portfolios accordingly were better positioned to navigate the crisis.

Conclusion

In conclusion, the US stock exchange indices are vital tools for investors to understand the market's direction and make informed decisions. By familiarizing themselves with the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, investors can gain valuable insights into the broader market and identify potential opportunities. Whether you are a seasoned investor or just starting out, understanding these indices is essential for success in the stock market.

Is the US Stock Market Open on July 3rd?? new york stock exchange