Introduction

The stock market is a powerful tool for building wealth, but it can also be a source of anxiety and uncertainty. With the global economy constantly evolving, many investors are left wondering whether now is the right time to invest in US stocks. This article aims to provide you with a comprehensive guide to help you make an informed decision.

Understanding the Current Market Landscape

The stock market is influenced by a variety of factors, including economic indicators, geopolitical events, and corporate earnings. Before deciding whether to invest in US stocks, it's crucial to understand the current market landscape.

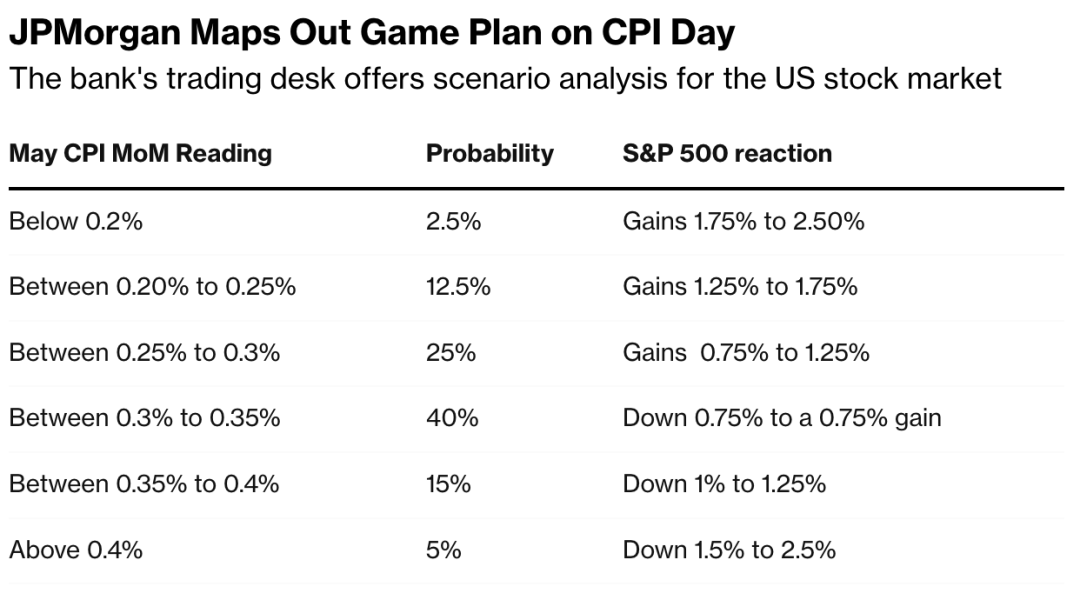

1. Economic Indicators

Economic indicators such as unemployment rates, inflation, and GDP growth can provide insights into the overall health of the economy. As of now, the US economy is experiencing low unemployment rates and steady GDP growth, which suggests a positive environment for stocks.

2. Geopolitical Events

Geopolitical events, such as trade tensions and political instability, can have a significant impact on the stock market. While there are some concerns about these factors, it's important to consider the long-term outlook for the US economy.

3. Corporate Earnings

Corporate earnings are a key driver of stock prices. With many companies reporting strong earnings, there is a strong case for investing in US stocks.

Types of Stocks to Consider

When investing in US stocks, it's important to consider different types of stocks based on your investment goals and risk tolerance.

1. Blue-Chip Stocks

Blue-chip stocks are shares of well-established companies with a history of stable earnings and dividends. These stocks are often considered a safe investment, as they tend to be less volatile than other types of stocks.

2. Growth Stocks

Growth stocks are shares of companies that are expected to grow at an above-average rate. These stocks can offer higher returns, but they also come with higher risk.

3. Value Stocks

Value stocks are shares of companies that are trading at a lower price relative to their intrinsic value. These stocks can offer good value for investors looking for long-term growth.

Case Studies

To provide a clearer picture, let's consider a few case studies of successful investments in US stocks.

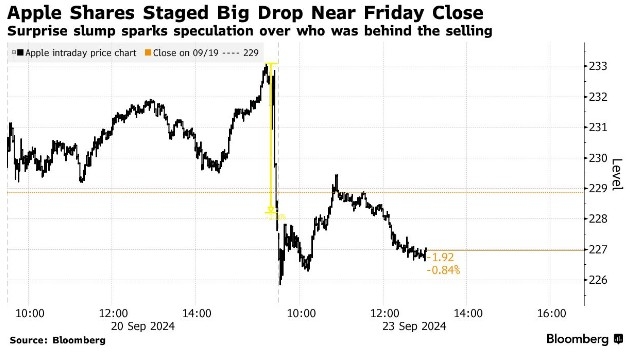

1. Apple Inc.

Apple Inc. has been a top-performing stock over the past few years. Its strong product lineup, innovative culture, and high margins have made it a favorite among investors.

2. Amazon.com Inc.

Amazon.com Inc. has revolutionized the retail industry with its e-commerce platform. Its continuous expansion into new markets and strong revenue growth have made it a compelling investment.

3. Tesla, Inc.

Tesla, Inc. has become a symbol of the electric vehicle revolution. Its commitment to innovation and leadership in the EV market has made it an attractive investment for many.

Conclusion

In conclusion, investing in US stocks can be a lucrative opportunity for investors looking to grow their wealth. However, it's crucial to conduct thorough research and consider your investment goals and risk tolerance before making a decision. By understanding the current market landscape and diversifying your portfolio, you can increase your chances of success in the stock market.

Kuvera Invest in US Stocks: A Strategic App? new york stock exchange