In the heart of the financial world, the United States Stock Exchange (often referred to as the US Stock Exchange) stands as a beacon for investors, businesses, and financial markets. This article delves into the definition, history, and significance of the US Stock Exchange, highlighting its role in shaping the global financial landscape.

What is the US Stock Exchange?

The US Stock Exchange is a marketplace where buyers and sellers trade stocks, bonds, and other securities. It serves as a platform for companies to raise capital and for investors to invest in these companies. The primary purpose of the US Stock Exchange is to facilitate the efficient transfer of ownership of financial securities.

The History of the US Stock Exchange

The US Stock Exchange has a rich history that dates back to the 18th century. The first organized stock exchange in America was the New York Stock Exchange (NYSE), which was established in 1792. Over the years, other stock exchanges have emerged, including the NASDAQ, which was founded in 1971.

Types of US Stock Exchanges

The US Stock Exchange is divided into two main types: the primary market and the secondary market.

- Primary Market: This is where companies issue new securities for the first time. Investors buy these securities directly from the company, and the proceeds are used by the company for expansion or other purposes.

- Secondary Market: This is where investors buy and sell existing securities among themselves. The most famous secondary market is the New York Stock Exchange (NYSE), where shares of publicly-traded companies are bought and sold.

Significance of the US Stock Exchange

The US Stock Exchange plays a crucial role in the global financial system for several reasons:

- Capital Formation: It provides a platform for companies to raise capital, which is essential for growth and expansion.

- Price Discovery: The US Stock Exchange facilitates the discovery of fair prices for securities based on supply and demand.

- Market Liquidity: It provides liquidity to investors, allowing them to buy and sell securities easily.

- Investment Opportunities: It offers a wide range of investment opportunities, from small-cap stocks to large-cap blue-chip companies.

Case Studies

To illustrate the impact of the US Stock Exchange, let's consider two case studies:

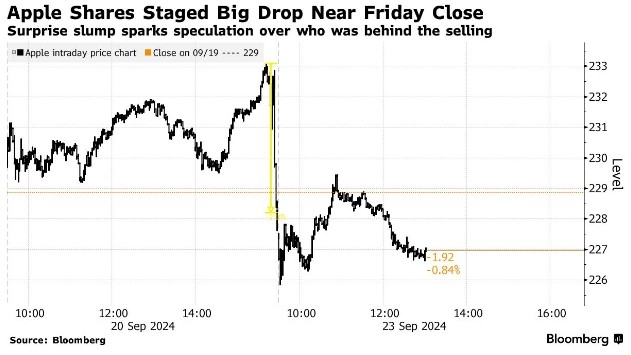

Apple Inc.: Apple, Inc. (AAPL) is a prime example of a company that raised capital through the US Stock Exchange. In 1980, Apple went public and listed its shares on the NASDAQ. Since then, it has raised billions of dollars through its stock offerings, which have been instrumental in its growth and success.

Tesla, Inc.: Tesla, Inc. (TSLA) is another example of a company that has leveraged the US Stock Exchange to raise capital. In 2010, Tesla went public and listed its shares on the NASDAQ. The funds raised through its stock offerings have been crucial in developing its electric vehicle technology and expanding its market presence.

Conclusion

The US Stock Exchange is a cornerstone of the global financial system, providing a platform for companies to raise capital and investors to invest in these companies. Its role in facilitating capital formation, price discovery, and market liquidity cannot be overstated. As the financial hub of America, the US Stock Exchange continues to shape the global financial landscape.

Largest Stocks by Market Cap US: The Titans? new york stock exchange