In the ever-evolving world of finance, microcap stocks have emerged as a popular investment choice for many. These stocks, which represent companies with a market capitalization of less than $300 million, offer investors the chance to tap into high-growth potential with potentially significant returns. In this article, we delve into the latest news and insights about US microcap stocks, highlighting key developments and analysis.

Understanding Microcap Stocks

Microcap stocks are often associated with smaller, emerging companies that may not yet have the widespread recognition of their larger counterparts. However, this does not diminish their potential for growth. In fact, many successful companies began as microcap stocks before scaling up to become industry leaders.

Recent Developments in the Microcap Stock Market

Rising Interest Rates: The Federal Reserve's recent decision to raise interest rates has had a significant impact on the microcap stock market. While higher interest rates can lead to increased borrowing costs for companies, they can also attract investors seeking higher yields. This has created a mixed bag of opportunities and challenges for microcap stocks.

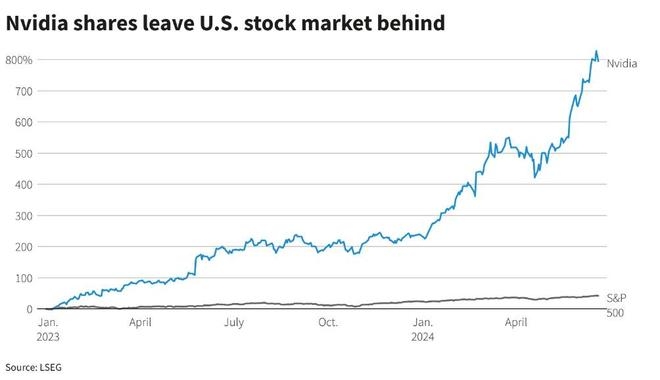

Tech Sector Boom: The technology sector has been a major driver of growth in the microcap stock market. Companies specializing in emerging technologies, such as artificial intelligence, blockchain, and biotechnology, have seen substantial gains. This trend is expected to continue as these sectors continue to evolve.

Mergers and Acquisitions: The microcap stock market has seen an increase in merger and acquisition (M&A) activity. Larger companies are looking to acquire smaller, innovative firms to expand their product offerings and market share. This has created opportunities for investors to benefit from potential synergies and increased valuations.

Key Insights for Investors

Thorough Research: Investing in microcap stocks requires thorough research and due diligence. Investors should carefully analyze the financial health, business model, and management team of each company before making an investment.

Risk Management: Microcap stocks are inherently riskier than larger, more established companies. Investors should be prepared for potential volatility and be willing to accept higher levels of risk.

Diversification: To mitigate risk, it is advisable to diversify your investment portfolio by including a mix of microcap stocks across various sectors and industries.

Case Study: XYZ Corporation

Let's take a look at XYZ Corporation, a microcap stock that has seen significant growth in recent years. The company specializes in developing cutting-edge software solutions for the healthcare industry. After conducting thorough research, investors recognized the company's innovative technology and strong management team. As a result, the stock experienced a remarkable increase in value, providing substantial returns for early investors.

In conclusion, US microcap stocks offer investors the opportunity to tap into high-growth potential with potentially significant returns. However, it is crucial to conduct thorough research and exercise proper risk management to succeed in this volatile market. Stay informed about the latest news and insights to make informed investment decisions.

US China Trade Talks: A Game-Changer for th? new york stock exchange