Introduction

The US large cap stock market has long been a bellwether for the broader market. As we approach September 2025, it's crucial to understand the latest trends and potential opportunities within this segment. This article delves into the current landscape, analyzing key factors influencing large cap stocks and providing insights into where the market might be heading.

Market Overview

The US large cap stock market, encompassing companies with a market capitalization of over $10 billion, has experienced significant growth over the past few years. This segment has been driven by strong fundamentals, including robust earnings, innovation, and a favorable regulatory environment.

Economic Factors

Economic factors play a crucial role in shaping large cap stock trends. In September 2025, several key economic indicators are likely to impact the market:

- Interest Rates: The Federal Reserve's monetary policy decisions regarding interest rates will significantly influence large cap stocks. A decrease in interest rates can boost stock prices, while an increase can have the opposite effect.

- Inflation: Controlling inflation remains a top priority for the Federal Reserve. If inflation remains high, it could lead to a tighter monetary policy, affecting large cap stocks negatively.

- Economic Growth: The pace of economic growth also impacts large cap stocks. A strong economy can lead to higher corporate earnings and stock prices, while a slowdown can have the opposite effect.

Sector Trends

Different sectors within the large cap market are likely to experience varying trends in September 2025:

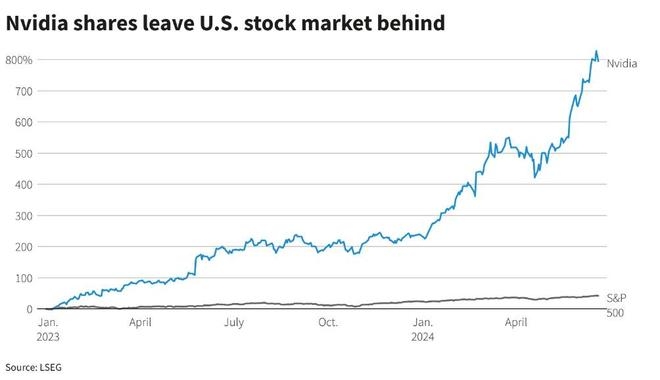

- Technology: The technology sector, particularly companies like Apple (AAPL), Microsoft (MSFT), and Google (GOOGL), has been a major driver of growth in the large cap market. With the rise of cloud computing, 5G, and AI, this sector is expected to continue its upward trend.

- Healthcare: The healthcare sector, including pharmaceutical companies like Pfizer (PFE) and biotech firms like Amgen (AMGN), has been a stable performer. With an aging population and advancements in medical technology, this sector is likely to remain a strong performer.

- Financials: The financial sector, including banks and insurance companies, has been experiencing mixed results. With regulatory changes and a low-interest-rate environment, this sector is expected to see moderate growth.

Company-Specific Trends

Several individual companies within the large cap market are expected to perform well in September 2025:

- Amazon (AMZN): As an e-commerce and cloud computing giant, Amazon has been a major player in the large cap market. With its strong growth prospects and innovative business model, Amazon is likely to continue its upward trend.

- Facebook (META): Despite recent controversies, Facebook remains a dominant player in the social media space. With its ongoing efforts to diversify its revenue streams and improve user experience, Facebook is expected to recover and perform well.

- Tesla (TSLA): As the leader in electric vehicle (EV) manufacturing, Tesla has been a significant growth story in the large cap market. With the increasing demand for EVs and the expansion of its global footprint, Tesla is expected to continue its upward trajectory.

Conclusion

The US large cap stock market trends in September 2025 are shaped by a combination of economic factors, sector trends, and company-specific developments. By understanding these factors, investors can make informed decisions and identify potential opportunities within this segment. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

US Magnesium Stock Price Today: A Comprehen? new york stock exchange