The US Steel Group has been a significant player in the steel industry for decades, and its stock has captured the attention of investors worldwide. In this article, we'll delve into the factors that affect the US Steel Group stock, its market performance, and what investors should consider before making their decisions.

Understanding US Steel Group Stock

The US Steel Group, also known as United States Steel Corporation, is an American multinational metal production company. The company operates in various segments, including flat-rolled steel, tubular products, and raw materials. Its stock is traded on the New York Stock Exchange (NYSE) under the ticker symbol X.

Market Performance and Trends

The performance of the US Steel Group stock is closely tied to the broader steel industry and global economic conditions. The stock has experienced fluctuations over the years, reflecting the volatility in the steel market. Here are some key trends and factors that impact the stock:

Economic Conditions: The demand for steel is highly dependent on economic growth. In times of economic prosperity, the demand for steel increases, leading to higher prices and profits for steel companies. Conversely, during economic downturns, demand for steel decreases, leading to lower prices and profits.

Supply and Demand: The balance between steel supply and demand is a critical factor affecting the stock. An oversupply of steel can lead to lower prices, while a shortage can drive up prices. The US Steel Group's ability to manage its production and adjust to market conditions is crucial for its stock performance.

Commodity Prices: The prices of raw materials, such as iron ore and coal, play a significant role in the cost of steel production. Fluctuations in these commodity prices can impact the profitability of the company and, consequently, its stock.

Regulatory Environment: The steel industry is subject to various regulations, including environmental and trade policies. Changes in these regulations can affect the operating costs and profitability of the company, which in turn can impact the stock.

Investment Considerations

Investors considering investing in the US Steel Group stock should take the following factors into account:

Dividend Yield: The US Steel Group has a history of paying dividends to its shareholders. However, the dividend yield can fluctuate based on the company's profitability and market conditions.

P/E Ratio: The price-to-earnings (P/E) ratio is a popular valuation metric used by investors. A lower P/E ratio may indicate that the stock is undervalued, while a higher P/E ratio may suggest that the stock is overvalued.

Technical Analysis: Investors often use technical analysis to predict future stock movements. This involves analyzing historical price data and identifying patterns that may indicate future trends.

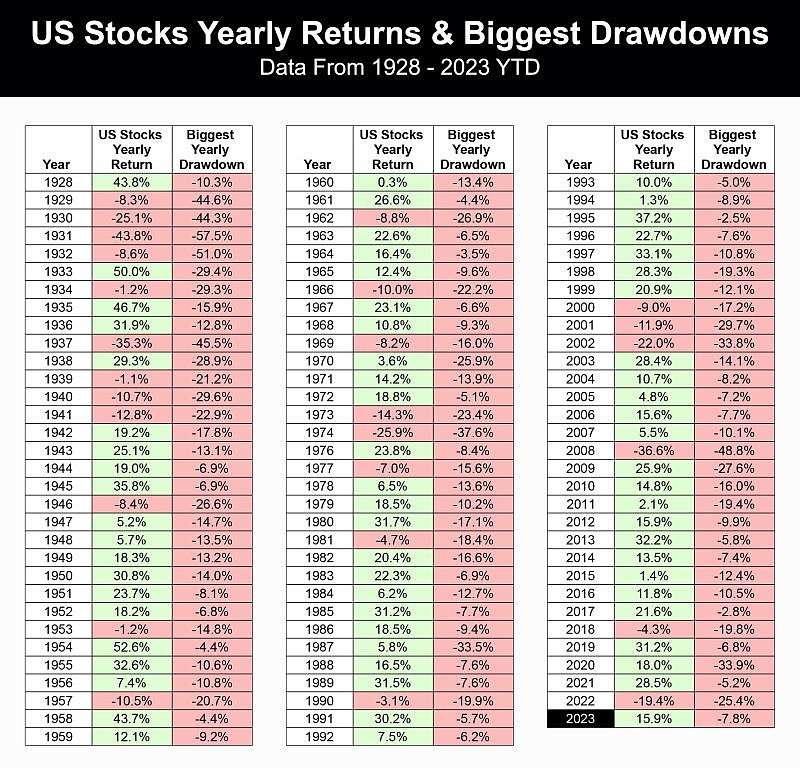

Case Study: The 2008 Financial Crisis

A notable case study involving the US Steel Group stock is the 2008 financial crisis. During this period, the global steel industry experienced a severe downturn, leading to a significant decline in the stock price of the US Steel Group. However, the company managed to navigate through the crisis and eventually recover, demonstrating its resilience.

In conclusion, the US Steel Group stock is influenced by various factors, including economic conditions, supply and demand, commodity prices, and regulatory changes. Investors should carefully consider these factors before making their decisions. While the stock has experienced volatility, its long-standing position in the steel industry and ability to adapt to market conditions make it a compelling investment opportunity for those with a long-term perspective.

Stock Data for US Bank Symbol USB from Yaho? us stock market today live cha