As we delve into the latter part of 2025, the US stock market continues to exhibit remarkable resilience and dynamism. This article provides a comprehensive analysis of the current state of the US stock market, focusing on key trends, sectors, and potential future directions.

Market Overview

The US stock market has experienced a remarkable recovery since the beginning of the year, driven by strong economic indicators, corporate earnings, and favorable global conditions. The S&P 500, a widely followed benchmark index, has seen significant gains, reflecting the overall health of the market.

Sector Performance

Several sectors have performed exceptionally well in the current market environment. Technology, healthcare, and consumer discretionary stocks have been among the top performers. This can be attributed to factors such as increased consumer spending, innovation, and favorable regulatory environments.

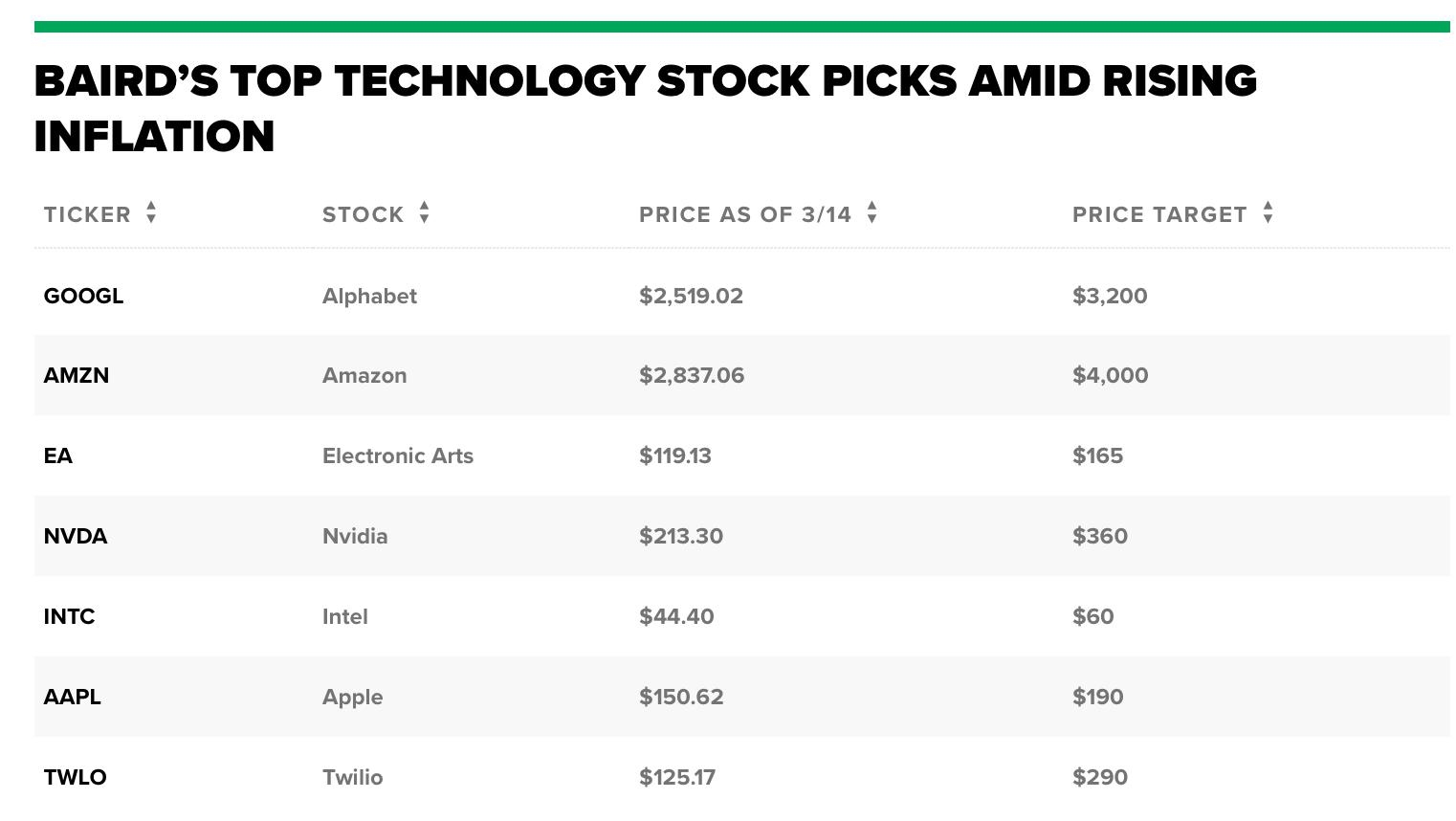

Technology Sector: The technology sector has been a standout performer, driven by strong demand for software, cloud computing, and hardware. Companies like Apple, Microsoft, and Amazon have seen significant growth, contributing to the overall strength of the sector.

Healthcare Sector: The healthcare sector has also seen strong gains, driven by increased demand for medical services and pharmaceuticals. Companies like Johnson & Johnson and Pfizer have been among the top performers in this sector.

Consumer Discretionary Sector: The consumer discretionary sector has benefited from increased consumer spending, particularly in areas such as travel, leisure, and retail. Companies like Disney and Nike have seen significant growth, reflecting the strong consumer sentiment in these areas.

Emerging Trends

Several emerging trends are shaping the current US stock market landscape. These include:

E-commerce Growth: The rise of e-commerce has continued to reshape the retail landscape, with companies like Amazon and Walmart leading the way. This trend is expected to persist, driven by increasing consumer preference for online shopping.

Green Energy Transition: The transition to green energy has gained momentum, with increased investment in renewable energy sources and electric vehicles. Companies like Tesla and SolarEdge have seen significant growth, reflecting the growing importance of green energy in the market.

Remote Work and Collaboration: The rise of remote work and collaboration tools has been a significant trend in the technology sector. Companies like Zoom and Microsoft have seen substantial growth, driven by increased demand for these tools.

Case Studies

Several notable case studies illustrate the current trends in the US stock market:

Tesla: Tesla has been a standout performer in the green energy sector, driven by its leadership in electric vehicles and renewable energy solutions. The company's recent announcement of its new Cybertruck has generated significant buzz and excitement in the market.

Zoom: Zoom has seen remarkable growth, driven by increased demand for remote collaboration tools during the COVID-19 pandemic. The company's recent IPO has been one of the most successful in recent memory.

Disney: Disney has experienced a strong recovery, driven by increased demand for streaming services and theme park visits. The company's recent acquisition of 20th Century Fox has further strengthened its position in the entertainment industry.

Conclusion

The US stock market has continued to exhibit remarkable resilience and dynamism in 2025. With strong sector performance, emerging trends, and notable case studies, the market remains a compelling investment opportunity. As we move forward, investors should remain focused on sectors such as technology, healthcare, and consumer discretionary, as well as emerging trends like e-commerce, green energy, and remote work.

Adani Stocks in the US Market: A Comprehens? us stock market today