In the vast and dynamic world of finance, the US stock market average plays a pivotal role in reflecting the overall health and performance of the market. This article delves into the intricacies of the US stock market average, providing a comprehensive guide for investors and enthusiasts alike.

What is the US Stock Market Average?

The US stock market average, often referred to as the "market average" or "market index," is a statistical measure that represents the overall performance of a group of stocks. It serves as a benchmark for investors to gauge the market's direction and to make informed decisions about their investments.

The most well-known US stock market average is the S&P 500 (Standard & Poor's 500 Index). This index tracks the performance of 500 large companies from various sectors across the United States. The S&P 500 is widely regarded as a proxy for the overall performance of the US stock market.

How is the US Stock Market Average Calculated?

The US stock market average is calculated using a specific formula that takes into account the market capitalization of each company in the index. Market capitalization is the total value of a company's outstanding shares of stock and is calculated by multiplying the number of shares by the current market price.

The formula for calculating the US stock market average is as follows:

Market Average = (Sum of Market Capitalizations of Companies in the Index) / Number of Companies in the Index

Why is the US Stock Market Average Important?

The US stock market average is a crucial tool for investors for several reasons:

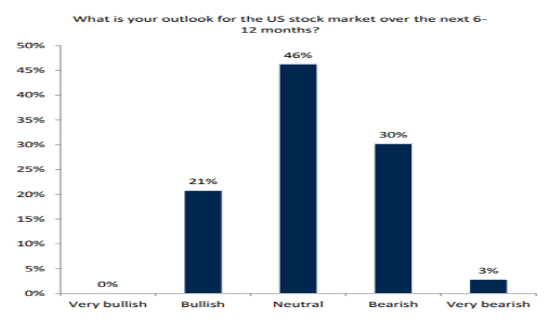

Market Trend Analysis: The US stock market average provides a snapshot of the overall market trend. Investors can use this information to make informed decisions about their investments.

Comparison with Individual Stocks: The US stock market average can be used to compare the performance of individual stocks with the overall market. This helps investors assess whether a particular stock is outperforming or underperforming the market.

Investment Strategy: The US stock market average can guide investors in developing their investment strategies. For example, if the market average is rising, it may indicate a favorable market environment for investing.

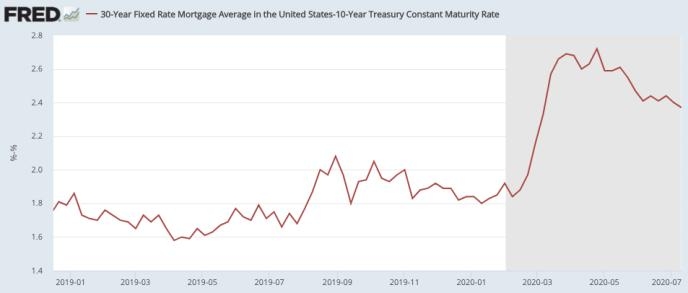

Case Study: The S&P 500 During the COVID-19 Pandemic

One notable example of the impact of the US stock market average is during the COVID-19 pandemic. In early 2020, the S&P 500 experienced a sharp decline as the pandemic spread globally. However, as the situation improved and economies began to recover, the S&P 500 rebounded strongly, showcasing the resilience of the market.

Conclusion

Understanding the US stock market average is essential for investors looking to navigate the complexities of the financial markets. By analyzing the market average, investors can gain valuable insights into market trends, compare individual stocks, and develop effective investment strategies.

Best Stock Broker for Non-US Residents: A C? us stock market live