Introduction: The upcoming US election is a hot topic that has everyone talking, including investors and stock market analysts. The election not only shapes the political landscape but also has a significant impact on the stock market. In this article, we'll explore the potential effects of the US election on the stock market, including key sectors that could be affected.

Political Uncertainty and Market Volatility

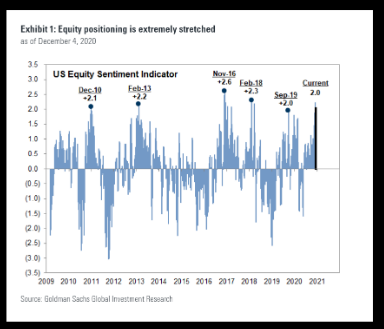

The election is often a source of political uncertainty, which can lead to increased market volatility. Historically, the stock market tends to react negatively to uncertainty, especially when it comes to elections. This uncertainty can lead to increased selling pressure and volatility in the market, as investors try to predict the potential outcomes.

Sector Impact: Technology and Healthcare

One of the most affected sectors during the election season is technology. Tech stocks often face increased volatility due to their high sensitivity to regulatory changes. For instance, if the Democratic candidate wins the election, there's a possibility of increased regulation on tech companies, which could lead to a sell-off in tech stocks.

On the other hand, healthcare stocks might see a boost in the stock market if the Democratic candidate wins. This is because the Democratic party often supports increased government spending on healthcare, which can lead to higher revenues for healthcare companies.

Sector Impact: Energy and Financial

The energy sector can also be significantly impacted by the election results. If the Republican candidate wins, we might see an increase in fossil fuel production, which could benefit energy companies. Conversely, if the Democratic candidate wins, there might be a push for renewable energy, which could negatively impact fossil fuel companies.

The financial sector is another key area that can be affected by the election. If the Republican candidate wins, we might see an increase in deregulation, which could lead to higher profits for financial institutions. However, if the Democratic candidate wins, there might be increased oversight and regulation, which could have a negative impact on the financial sector.

Economic Policies and Interest Rates

The election can also have an impact on economic policies and interest rates. If the Democratic candidate wins, we might see increased government spending and lower interest rates, which can stimulate economic growth and benefit the stock market. Conversely, if the Republican candidate wins, we might see a focus on tax cuts and reduced government spending, which could lead to higher interest rates and a potential slowdown in economic growth.

Case Studies: 2016 and 2020 Elections

Let's look at two recent election cycles to understand the potential impact on the stock market. In the 2016 election, the market reacted positively to the surprise win by Donald Trump. The S&P 500 index rallied significantly in the days following the election, as investors anticipated tax cuts and deregulation.

In the 2020 election, the stock market initially reacted negatively to the news of Joe Biden's win, due to concerns about increased government spending and regulation. However, the market quickly recovered, as investors focused on the potential for economic stimulus and lower interest rates.

Conclusion:

The upcoming US election is a significant event that can have a profound impact on the stock market. While political uncertainty often leads to increased market volatility, certain sectors and economic policies may see specific benefits or drawbacks depending on the election results. As investors, it's essential to stay informed and adapt our strategies accordingly.

Different US Stock Exchanges: A Comprehensi? us stock market live