In the fast-paced world of finance, staying updated with the latest stock market data is crucial for investors and traders. The US stock market, being one of the largest and most influential in the world, plays a pivotal role in global financial markets. This article provides a comprehensive overview of the current US stock market data, highlighting key trends, factors, and insights.

Market Performance

As of the latest data, the US stock market has experienced a robust performance, with major indices like the S&P 500 and the NASDAQ hitting record highs. The S&P 500, which represents the performance of 500 large companies, has seen a significant increase in its value over the past year, reflecting the overall strength of the US economy.

Sector Performance

Different sectors within the US stock market have performed differently. Technology stocks, particularly those in the tech-heavy NASDAQ index, have been a major driver of market growth. Companies like Apple, Microsoft, and Amazon have seen substantial gains, contributing to the overall market performance.

On the other hand, sectors like energy and financials have faced challenges due to factors like rising interest rates and global economic uncertainties. However, it's important to note that diversification remains key in managing investment risks.

Economic Factors

Several economic factors have influenced the US stock market's performance. The Federal Reserve's monetary policy, including interest rate decisions, has been a significant driver. The Fed's recent hikes in interest rates have impacted various sectors differently, with some companies benefiting from higher yields and others facing increased borrowing costs.

Additionally, global economic conditions, such as trade tensions and geopolitical events, have played a role in shaping the market's trajectory. For instance, the ongoing trade war between the US and China has created uncertainty in the market, affecting companies with significant exposure to the Chinese market.

Market Volatility

The US stock market has experienced periods of volatility, particularly during times of economic uncertainty or significant news events. The recent COVID-19 pandemic is a prime example, where the market saw a sharp decline followed by a rapid recovery. Understanding market volatility is crucial for investors to make informed decisions.

Investment Opportunities

Despite the challenges, the US stock market continues to offer attractive investment opportunities. Investors can capitalize on various sectors and investment strategies, including dividend stocks, growth stocks, and value stocks. It's important to conduct thorough research and consider factors like company fundamentals, market trends, and economic indicators before making investment decisions.

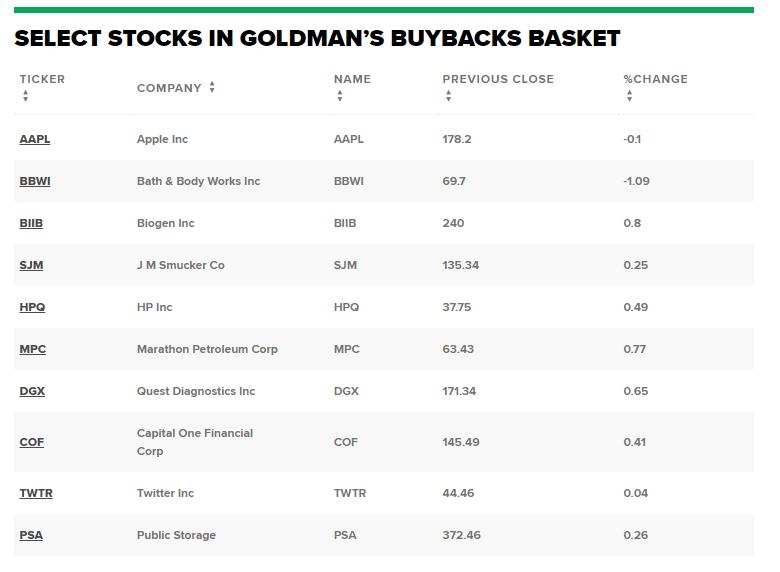

Case Study: Apple Inc.

A notable example of a company that has performed well in the US stock market is Apple Inc. The tech giant has seen significant growth in its stock price over the years, driven by its strong product lineup, innovation, and market dominance. Apple's success highlights the potential of investing in well-performing companies within the technology sector.

Conclusion

The US stock market remains a vital component of the global financial landscape. Understanding the current stock market data, including market performance, economic factors, and investment opportunities, is essential for investors and traders. By staying informed and making informed decisions, investors can navigate the complexities of the market and achieve their financial goals.

Netflix Earnings Beat Boosts US Stock Futur? us stock market live