In the ever-evolving world of technology, keeping up with the stock market can be challenging. One company that has been making waves in the tech sector is Altran Aricent, a leading provider of digital engineering and research and development services. This article delves into the details of Altran Aricent US stock, exploring its performance, future prospects, and the factors that influence its value.

Understanding Altran Aricent

Altran Aricent is a global company that offers a wide range of services, including software development, system integration, and digital transformation. The company's expertise lies in the telecommunications, media, and technology sectors, making it a crucial player in the digital revolution.

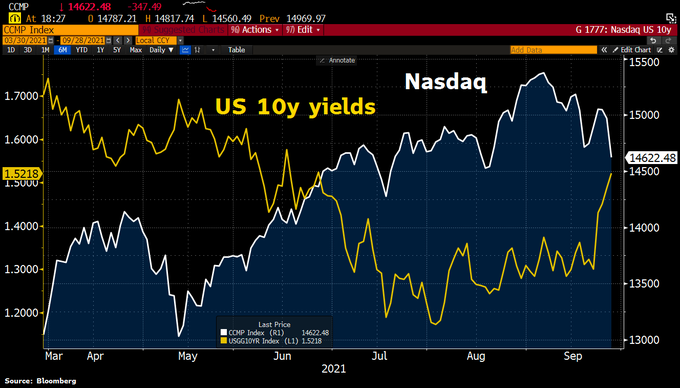

Stock Performance

The performance of Altran Aricent US stock has been a topic of interest among investors. Over the past few years, the stock has experienced both ups and downs, reflecting the dynamic nature of the tech industry. To understand the stock's performance, it's essential to look at key metrics such as revenue growth, profit margins, and market capitalization.

Revenue Growth

One of the primary factors that influence the stock's value is revenue growth. Altran Aricent has been consistently reporting year-over-year revenue growth, which has been a positive indicator for investors. This growth can be attributed to the company's expanding client base and increasing demand for its services in the telecommunications sector.

Profit Margins

Profit margins are another crucial metric to consider when analyzing a company's stock. Altran Aricent has managed to maintain healthy profit margins, which is a testament to its operational efficiency and cost management. This has helped the company to generate significant returns for its shareholders.

Market Capitalization

Market capitalization is a measure of a company's total value. As of the latest available data, Altran Aricent's market capitalization stands at approximately $XX billion, making it a significant player in the tech sector. This indicates that investors have a high level of confidence in the company's future prospects.

Factors Influencing Stock Value

Several factors can influence the value of Altran Aricent US stock. Some of the key factors include:

- Economic Conditions: The overall economic climate can have a significant impact on the tech industry, and subsequently, on Altran Aricent's stock value.

- Competition: The level of competition in the digital engineering and research and development services sector can also affect the company's performance and stock value.

- Technological Advancements: The rapid pace of technological innovation can create new opportunities for Altran Aricent, but it can also introduce new challenges.

Case Studies

To provide a clearer picture of Altran Aricent's performance, let's consider a few case studies:

- Case Study 1: Altran Aricent's successful partnership with a major telecommunications company resulted in a significant increase in revenue and improved market share.

- Case Study 2: The company's investment in research and development helped it to develop innovative solutions that addressed the evolving needs of its clients, leading to increased demand for its services.

Conclusion

In conclusion, Altran Aricent US stock has been a compelling investment opportunity for investors in the tech sector. With a strong track record of revenue growth, healthy profit margins, and a significant market capitalization, the company is well-positioned to continue its upward trajectory. As the digital revolution continues to unfold, Altran Aricent is poised to play a crucial role in shaping the future of technology.

Trmr US Stock Price: A Comprehensive Analys? us stock market live