In the dynamic world of the stock market, investors often find themselves analyzing the performance of various companies. One such company is US Silica Holdings Inc., a leading producer and supplier of high-quality industrial minerals. This article delves into the factors that influence the stock price of US Silica Holdings and provides valuable insights for investors.

Market Performance and Stock Price Dynamics

The stock price of US Silica Holdings, like any other publicly-traded company, is influenced by a multitude of factors. One of the primary drivers is the company's financial performance. This includes earnings reports, revenue growth, and profitability. When the company releases positive financial results, investors tend to be optimistic, leading to an increase in the stock price. Conversely, poor financial performance can result in a decline in the stock price.

Industry Trends and Market Conditions

Another crucial factor that affects the stock price of US Silica Holdings is the industry in which it operates. The industrial minerals industry is highly cyclical, with fluctuations in demand and prices driven by factors such as construction, energy, and environmental regulations. For instance, during periods of strong economic growth, demand for industrial minerals tends to rise, leading to higher stock prices. Conversely, during economic downturns, demand may decline, negatively impacting stock prices.

Economic Indicators and Macroeconomic Factors

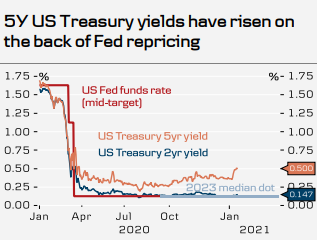

The broader economic environment also plays a significant role in determining the stock price of US Silica Holdings. Macroeconomic factors such as interest rates, inflation, and unemployment rates can impact the demand for industrial minerals and, consequently, the stock price. For example, a decrease in interest rates can stimulate economic activity, leading to increased demand for industrial minerals and a potential rise in the stock price.

Dividends and Stock Splits

US Silica Holdings has a history of paying dividends to its shareholders, which can also influence the stock price. A company that consistently pays dividends is often perceived as financially stable and reliable, attracting investors seeking income. Additionally, stock splits can impact the stock price. A stock split increases the number of shares outstanding, which can lead to a lower stock price, potentially making the stock more accessible to a broader range of investors.

Case Studies: US Silica Holdings Stock Price Performance

To illustrate the factors mentioned above, let's consider a few case studies involving US Silica Holdings.

Case Study 1: Economic Downturn

During the 2008-2009 financial crisis, the stock price of US Silica Holdings experienced a significant decline. This decline was primarily driven by the decrease in demand for industrial minerals due to the economic downturn. As the economy recovered, the stock price gradually began to rise, reflecting the improving market conditions.

Case Study 2: Dividend Increase

In 2019, US Silica Holdings announced an increase in its quarterly dividend, which was well received by investors. This news led to a rise in the stock price, as it indicated the company's confidence in its financial stability and future prospects.

Conclusion

Understanding the factors that influence the stock price of US Silica Holdings is crucial for investors looking to make informed decisions. By considering market performance, industry trends, economic indicators, and dividend payments, investors can gain valuable insights into the potential risks and rewards associated with investing in this company.

Stocks with ADX Greater Than 20: A Guide to? us steel stock dividend