The stock market is a crucial indicator of the health of the U.S. economy. As investors and traders, it's essential to stay updated with the latest news and trends. In this article, we will delve into the current state of the U.S. stock market, examining key factors that could impact the economy.

Stock Market Performance

The U.S. stock market has seen significant growth over the past few years, with the S&P 500 reaching new highs. However, recent volatility has raised concerns among investors. In this section, we will explore the factors contributing to the stock market's performance.

Earnings Reports and Corporate Profits

One of the primary drivers of the stock market's growth has been strong corporate earnings. Many companies have reported robust profits, driven by factors such as increased consumer spending and improved business conditions. However, it's important to note that not all sectors have experienced the same level of growth.

Impact of Inflation

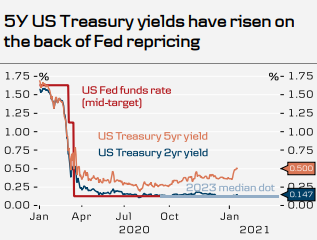

Inflation has been a hot topic in recent months, and it has had a significant impact on the stock market. As the Federal Reserve continues to raise interest rates to combat inflation, some sectors have been hit harder than others. For instance, technology stocks, which have been sensitive to inflation, have seen a decline in their valuations.

Market Volatility

Volatility has been a defining characteristic of the stock market in recent months. Several factors have contributed to this, including geopolitical tensions, rising inflation, and changes in monetary policy. As investors, it's essential to understand the risks associated with market volatility and develop a diversified investment strategy.

Geopolitical Tensions

Geopolitical tensions, particularly those involving Russia and Ukraine, have created uncertainty in the market. This uncertainty has led to increased volatility and has made it difficult for investors to predict market movements.

Monetary Policy

The Federal Reserve's decision to raise interest rates has had a significant impact on the stock market. As interest rates increase, borrowing costs rise, which can negatively affect corporate earnings and consumer spending. This has led to a decline in some sectors, such as real estate and utilities.

Sector Performance

Different sectors have performed differently in the current market environment. In this section, we will examine the performance of key sectors, including technology, financials, and energy.

Technology Sector

The technology sector has been a major driver of the stock market's growth, with companies such as Apple, Microsoft, and Amazon leading the way. However, recent volatility has caused some investors to question the sustainability of this growth.

Financial Sector

The financial sector has also experienced volatility, with banks and insurance companies facing increased regulatory scrutiny and higher interest rates. Despite these challenges, the sector has shown resilience and has continued to grow.

Energy Sector

The energy sector has been a bright spot in the current market environment, with oil prices reaching new highs. This has been driven by increased demand for energy and geopolitical tensions in the Middle East.

Conclusion

The U.S. stock market is a complex and dynamic entity, and it's essential for investors to stay informed about the latest news and trends. By understanding the factors driving market performance and sector trends, investors can make more informed decisions and manage their risks effectively.

Future US Stock Market Return: Predictions ? us steel stock dividend